Large projected fiscal burdens due to rapid population ageing are driving governments around the world to evaluate their existing economic policies. A key reform area is the public pension system, where politicians strive to increase pension funding and better target pension expenditure to seniors with limited private means. Since pension wealth (funded or otherwise) and residential real estate are the most important assets carried through to retirement, it is important to analyse how they interact with each other and to what extent they are impacted by national income tax and pension policies.

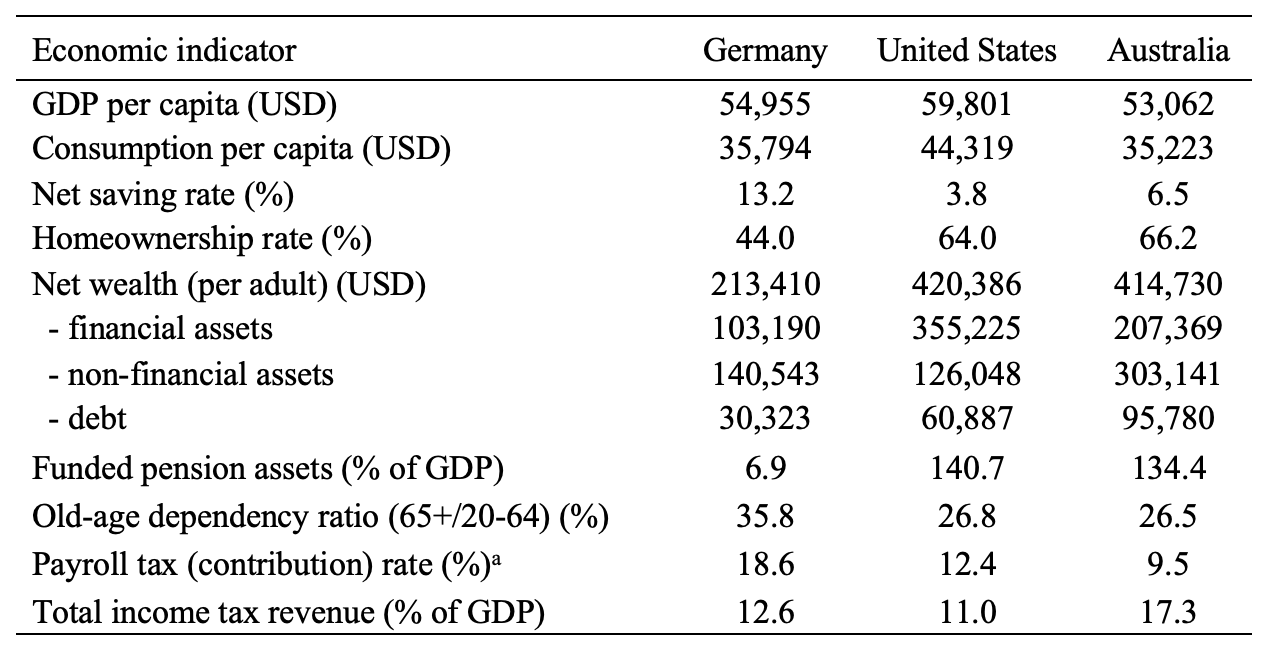

Germany, the United States and Australia are all ageing societies at a comparable stage of economic development with similar incomes per capita, but with significant differences in their wealth levels and homeownership rates. Germans are older on average and save significantly more than Americans and Australians (see in Table 1). One would therefore expect that Americans and Australians hold less wealth than Germans. However, average net wealth in the US and Australia is roughly twice as high as in Germany. The accumulated asset structures also differ significantly across these countries. While in Germany only about 44 per cent of households own their place of residence, owner occupied dwellings are the largest asset held by American and Australian households, with over two thirds of households living in their own home. Germans also hold relatively low savings in retirement accounts, while in the US and Australia, private pension entitlements are among the most important financial assets.

Table 1: Key economic indicators for Germany, the US and Australia in 2018*

Notes: *Taken from Fehr, Hofmann and Kudrna (2021); aIn Australia, there is no payroll tax financing public pensions so here we report the mandatory superannuation (private or funded pension) contribution rate, applicable in 2018.

Of course, many economic, socio-economic and political factors affect homeownership and wealth accumulation of a country. However, the specific cross-country observations described above indicate that these gaps in homeownership rates and wealth levels must be at least partly due to differences in national tax and pension policies. In our recent paper – Pensions, Income taxes and Homeownership: A Cross-Country Analysis, we analyse the role of these policies. More specifically, we show that the progressive income taxation and social security in the US, and the age pension and mandatory superannuation systems in Australia are able to explain more than half of the observed gaps in homeownership between Germany and the US and Germany and Australia, respectively. On average, net wealth of German households could be increased by 17 per cent if Germany were to adopt Australia’s income tax and retirement income policies.

Income tax and pension design comparison

In Germany, income tax revenues are collected from a progressive tax on labour and pension income and a proportional tax on capital income. In contrast to this German dual income tax system, in Australia and the US, labour and capital (assets) incomes are aggregated and taxed under their progressive income tax schedules. In addition, in the US and Australia, old-age savings are taxed at significantly lower rates. Finally, in the US, mortgage payments by owner-occupiers can be fully deducted from the taxable income, which is not allowed in Germany and Australia. Income tax revenues are highest in Australia and much lower in Germany and the US (see Table 1). Marginal income tax rates are similar in Germany and Australia, but much lower in the US.

Germany and the US run a pay-as-you-go financed statutory pension system with payroll taxes on workers financing pension benefits of current retirees. The German public pension system absorbs almost 12 per cent of GDP, whilst in comparison the US pension system is less costly and more redistributive (within cohort) than the German pension system.

In contrast, Australia provides tax-financed, means tested, old-age public pension benefits supplemented by a funded private pension system with mandatory contributions. Australia’s public age pension (the first pension pillar) is more modest than statutory pensions in Germany and the US. It does not depend on past earnings, and it is means tested, with around 30% of the age-eligible population (in other words, affluent elderly) not receiving any age pension. Interestingly, means-tested assets (that determine public old-age pension benefits) do not include owner-occupied real estate, which provides a clear incentive for homeownership in old-age.

In Australia, the second pension pillar is represented by compulsory superannuation (Australia’s term for private pensions or retirement accounts), which is a mandatory employment-related and privately managed scheme. It covers almost 95 per cent of Australian employees. It mandates employers to make contributions (9.5 per cent of gross wages in 2018, being gradually increased to 12 per cent in 2024) on behalf of their employees to the employee’s selected superannuation fund. Note that Germany and the US do not mandate contributions to retirement (private pension) accounts. But in the US, financial wealth dominates non-financial wealth and, at least partly, this is due to pension wealth in the form of funded private pension assets. As shown in Table 1, the latter is hardly existent in Germany, while such assets are very significant in the US and Australia.

Next, we briefly discuss the economic model that is applied to study the effects of these alternative tax and pension designs on homeownership, household net wealth and the economy.

Modelling

The model used to undertake this quantitative, cross-country analysis is a stochastic, general equilibrium model with overlapping generations (OLG model) where households have tenure choice and face uncertain labour income and survival. The model also distinguishes between three sources of household wealth – housing, liquid financial and (illiquid) pension assets. The initial benchmark equilibrium of the model is calibrated to Germany, applying the German statutory public pension and dual income tax systems. Then we run several counterfactual polices such as elimination of German social security and capital income taxation, and the introduction of the US and Australian income tax and pension policy designs, in order to study their economy wide effects.

Simulation findings

The modelling indicates that alternative policy designs have a dramatic impact on wealth and homeownership. The results also showed other significant effects of the differences in income tax and pension policies in Germany, the US and Australia on macroeconomic and fiscal aggregates such as GDP, consumption per capita and pension expenditure.

Specifically, for income taxation, we show that reduced labour income taxes lead to higher wealth accumulation and homeownership ratios, while reduced capital income taxation has positive effects on the economy and wealth but it reduces homeownership. The latter is due to the fact that the preferential tax treatment of owner-occupied housing (where the imputed returns on investment are not taxed at all) will be reduced. We also show that lower income taxes and progressive taxation of capital income in the US contributes to higher homeownership.

As for public pensions, we show that less generous pensions lead to higher homeownership because of lower payroll taxes (impacting disposable income available for the down payment). Hence, under the US policy, higher homeownership is due to less generous social security pensions and progressive capital income taxation. Under the counterfactual with Australia’s income taxation and age pension, the German homeownership ratio increases to 61.5 per cent, compared to 44 per cent in the benchmark model. This is driven by the Australian age pension that compared to the German public pension, is non-contributory and means tested with a more modest maximum pension benefit. In addition, homeownership is supported by the full exemption of owner-occupied housing from the age pension means test.

As opposed to the implications of the age pension on homeownership, mandatory superannuation has only small impact on the homeownership rate. While the impact of mandatory superannuation contributions on disposable income and the illiquid nature of superannuation assets (that you cannot access until you reach a certain age) may initially reduce ability to buy a house, we also find that people tend to borrow more in an economy with compulsory superannuation. Looking at the proportion of homeowners, the number of households with a mortgage has increased significantly. So, while Australians are a more asset-rich nation, they are also more indebted than the average German household. Importantly, we show that superannuation increases household net wealth through financial assets that (as indicated in Table 1) are more than double of average financial wealth in Germany.

Consequently, our cross-country analysis not only quantifies the importance of social security arrangements for homeownership and household wealth accumulation but also illustrates the link between pension policy and tenure choice – a gap in the literature to date.

Future research

The future work will extend the current tax and pension analysis with the housing OLG model to incorporate the demographic transition. The focus of this follow-up project will be on the welfare and aggregate efficiency implications of policy reforms, informing on optimal pension policy, accounting for the link between pensions and tenure choice under population ageing.

Recent Comments