Economists have known for a while that increasing globalisation leads to substantial but unequal gains and creates winners and losers.

This rising inequality could be attributed to globalisation’s heterogeneous effects on employment, wages, or prices. Trade barriers have been falling in the post-World War II era and have reached an all-time low since the middle of the 1990s. It appears this increasing globalisation may have negative effects on employment in certain sectors, states, and countries. Those in the affected markets may therefore require significant government help in the form of social insurance, unemployment benefits, or training and support to move to new jobs or industries.

Theoretically, inequality created through increasing globalisation could be lessened by local policies aimed at distributing some of the gains of globalisation from the winners to the losers, thereby ensuring that everyone receives a share of the benefits.

However, despite the sizable aggregate gains from trade, there is ongoing backlash against migration and trade, such as the US Trump administration’s tariffs and border wall policies, the Yellow Vest movement in France, and support for Brexit in the UK. This suggests that such redistributive mechanisms may not exist or benefits have not been distributed effectively.

A natural and frequently used tool of redistributive policy is a personal income tax system, which can be flat or progressive. Progressivity can be established not only through multi-level marginal tax tables, but also through tax credits or deductions for those at the bottom and middle of the income distribution. The pressure from increasing globalisation should prompt redistribution through income taxation to ensure that enough of the associated benefits are shared with the earners of lower incomes.

However, the tax burden has become higher for middle-income workers…

Our new study, published in the American Economic Review, shows that globalisation has had the opposite effect on income tax systems since the middle of the 1990s. A drastically higher relative tax burden has been set for middle- and upper-middle-income workers than for those in the top 5% of the income distribution.

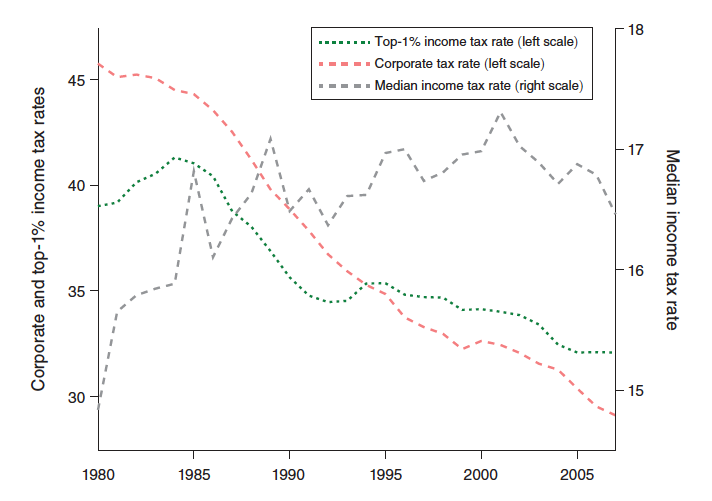

Figure 1: Average Corporate and Income Tax Rates

Figure 1 depicts the development of the average corporate and labor income tax rates in the 65 largest economies between 1980 and 2007. The average corporate tax rate (red line) has been steadily declining, illustrating “the race to the bottom” – the negative effect of countries’ competition to attract and retain firms on corporate tax rates across all locations.

In addition, Figure 1 also indicates that the top 1% of income earners may have experienced a similar decline since the 1980s. This trend may be further aggravated by the fact that a significant part of these workers’ incomes stems from non-labor income and may be subject to even lower taxes. Yet, at the same time, the average tax rate of the median worker has steadily increased. Therefore, why do workers in the middle of the income distribution face such different tax results compared to both firms and the rich?

Globalisation itself may be the answer

Reduced barriers to trade and migration have allowed firms and high-income earners to be very mobile. This naturally limits governments’ ability to tax these bases before the bases choose to relocate in order to lower their taxes. As a result, lower effective tax rates become an important factor in attracting foreign firms and highly skilled workers. Therefore, in an increasingly globalised world, redistribution through taxation is rendered much less feasible by the agility of firms and high-skilled (high-income) workers.

In response, governments around the world have begun to increasingly rely on immobile workers in order to stabilise their tax base. Typically, this immobility is a characteristic of those around the low to middle section of the income distribution. This is mainly attributed to the fact that their skills may not be easily transferred across borders or because a lack of resources may preclude them from relocating.

We estimate that between 1994 and 2007 the top 1% of income recipients in the average OECD country saw a reduction in their relative income tax of 0.59 to 1.45 percentage points. By contrast, the tax burden of the median earner has increased by 0.03 to 0.05 percentage points. These globalisation-induced changes in the income tax burden have exacerbated rather than mitigated net income inequality. This trend is likely to continue as the mobility of large companies and high-income workers continues to rise.

A supranational tax?

60% of respondents to a 2014 Pew survey felt that growing inequality was a major challenge and progressive taxation could be one of the ways to tackle this inequality.

However, increasing income tax progressivity may not be as simple as adding more deductions or tax credits or increasing the top marginal tax rates in a globalised world. The high mobility potential of high-income individuals (and firms) limits the ability of governments to tax them; therefore, as long as countries continue to aim to attract and retain high-skilled workers (and the firms that employ them), reducing inequality unilaterally will be challenging.

Another approach could be the multilateral harmonisation and coordination of international labour income tax policy. This proposal arises from our paper’s case study of the U.S. multi-tiered tax system, which uses cross-state migration in lieu of cross-border globalisation, and relative tax burdens in both the sub-national and total (national + sub-national) tax layers.

While the reduction in relative tax burden for those at the top of the income distribution prevails, the overall effect is diminished when the federal and state levels are considered together. A supranational tax layer, or at least supranational coordination, might curb the globalisation-induced changes in relative tax burdens across the income distribution.

Although multilateral tax coordination and harmonisation has been on the agenda for a while, there is little discussion about international coordination on personal income tax rates. It may be worthwhile to examine the costs and benefits of such coordination, especially given the growing mobility and increasing dissatisfaction of the public with inequality.

Recent Comments