In 2008, the Australian Government increased the excise tax on premixed alcoholic drinks, or alcopops, so that they were taxed at the same rate as spirits. The move was commonly referred to as the ‘alcopops tax’. It pushed the price of alcopops up by around 70 per cent, resulting in an increase in tax from $39.36 to $66.67 per litre of alcohol.

Using sales data, researchers have found that there were reductions in the sale of alcopops at the aggregate level after the tax was introduced. Until now, there have been no studies that have looked at how consumption patterns changed using individual-level data.

As in other high-income countries, youth drinking is declining in Australia. For example, surveys of high school students show that alcohol consumption has dropped substantially between 2008 and 2017. Until now, these trends have only been examined for alcohol in general, but there has been no detailed attempt to unpack the way that consumption of different beverages has shifted over time.

Our paper was the first to examine how beverage specific (beer, wine, spirits, alcopops) alcohol consumption changed in light of both the alcopops tax and the broader decline in youth drinking. We used data from the National Drug Strategy Household Survey (NDSHS) that asks Australians about their alcohol and other drug use every three years. We had a total of 23,536 respondents aged between 14 and 29 years across five waves of the NDSHS (2004, 2007, 2010, 2013 and 2016). Respondents were asked about their drinking in detail the day before the survey, which is less likely to be affected by memory or other biases than questions covering a longer period of time. Using this data on participants ‘yesterday drinking’, we were able to see if there were any changes in beverage consumption after the alcopops tax.

A 66 per cent decline in alcopops consumption amongst all youths

We found that there was a 46 per cent decline in Australian youth drinking between 2004 and 2016. With consumption dropping in a lot of high-income countries that didn’t change their taxation, this decline probably wasn’t entirely because of the alcopops tax. However, amongst all youth the consumption of alcopops (66 per cent) declined more than spirits (48 per cent), beer (46 per cent) and wine (33 per cent).

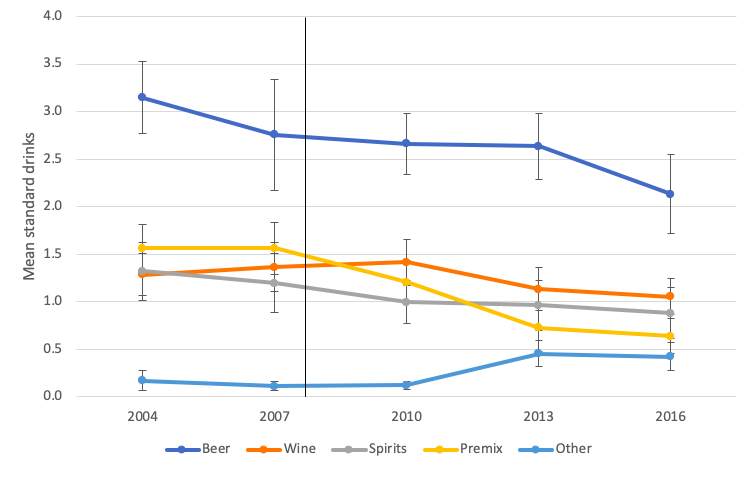

We were also interested in what beverages Australian youth were consuming in their ‘yesterday’ drinking occasion. Figure 1 below illustrates how much of each beverage type participants consumed among those who drank.

Among alcohol consumers, beer was the most consumed beverage across the study period and this consumption declined by 32 per cent between 2004 and 2016. Consumption of premixed beverages among drinkers peaked in 2004 and 2007 and then dropped by 59 per cent in 2016. The mean number of standard drinks for wine remained stable between 2004 and 2010 and reduced by 21 per cent in 2013 and 2016. The consumption of spirits declined by 31 per cent throughout the study period.

Figure 1. Mean standard drinks consumed by youth drinkers yesterday by beverage type across the five waves of the NDSHS with 95 per cent confidence intervals with a reference line in 2008 (when the tax was introduced).

Males and females responded differently

The mean number of standard drinks consumed were assessed for males and females. We found that both males and females drank less alcopops after the tax was introduced, although the reduction in alcopops consumption for females did not occur immediately in 2010. Young female drinkers also drank less wine after the alcopops tax. Meanwhile, males had an immediate increase in wine consumption in 2010 after the tax but since then their wine consumption has decreased.

We were also interested to see if there were any differences in beverage specific consumption between participants aged 14 to 21 and 22 to 29. Younger participants (aged 14 to 21) reported more standard drinks consumed as premix than older participants (aged 22 to 29). Both age groups had their premix consumption reduced by more than 50 per cent after the alcopops tax was introduced. Older participants also reported reductions in mean standard drinks consumed as spirits in 2013 and wine in 2016 compared with 2007.

Lastly, our study examined the beverage specific consumption of light (consumed less than five standard drinks) and risky drinkers (consumed five or more standard drinks). Premix consumption reduced by 50 per cent for both light and risky drinkers after the alcopops tax was increased.

Apart from the introduction of the alcopops tax, the Australian Government changes the alcohol excise rates twice a year, in line with the Consumer Price Index (CPI). We do not expect these changes in the excise rates to influence our results as they simply modify the tax to match inflation.

Taxation can influence youth alcohol consumption

In conclusion, we examined 13 years of survey data to see if the alcopops tax resulted in young people drinking less or simply changing their drink of choice. The results from our study indicate that youth drinking has declined during the study period and that the consumption of alcopops has declined faster than that of other beverages. These results provide more evidence that changes in taxation of alcohol products, when they are passed through to prices, can influence alcohol consumption, particularly for young people.

This article is based on Mojica‐Perez, Y., Callinan, S., & Livingston, M. (2020). Examining beverage‐specific trends in youth drinking in Australia before and after the implementation of the alcopops tax. Drug and Alcohol Review. https://doi.org/10.1111/dar.13038.

Recent Comments