The tax literature emphasizes two fundamental principles: efficiency and equity. People adjust their behavior in response to taxes leading to many distortions, such as discouraging work or distorting market prices. Such distortions lead to the loss of social welfare. Efficiency is concerned with reducing the loss of social welfare caused by distortions.

Equity, on the other hand, focuses on how the citizens share the tax burden. It focuses on distributive justice, meaning that taxes should be fair.

What are the criteria for determining the fairness of taxes? In the taxation literature, horizontal equity and vertical equity are the two fundamental commands of social justice. Horizontal equity requires equal treatment of equals, and vertical equity requires unequal treatment of unequal. These concepts are widely applied to assess equity in taxation. The two commands are not precise enough to measure them quantitatively. There may be few, or no equals in the real world. Similarly, it is difficult to know to what degree the unequal be treated unequally in the real world.

Measuring inequities in a country’s income tax system

Kakwani and Lambert (1998) introduced three equity principles, leading to the horizontal and vertical equity measurement using real-world data. It will be helpful to provide a brief discussion of these principles.

Suppose x1, x2, ————, xn are the pre-tax incomes of n individuals who are paying t1, t2, ————, tn amounts of tax.

Principle 1: xi ≥ xj → ti ≥ tj for all i and j.

This principle implies that the richer a person, the more tax she should pay because a richer person has more ability to pay tax than a poorer person. It means that the tax paid by individuals should increase monotonically with income. John Fei (1981) calls this requirement minimal progressivity.

Principle 2: xi ≥ xj and ti ≥ tj → ti/xi ≥ tj/xj for all i and j.

According to this axiom, richer individuals pay more tax and pay tax at a higher rate. Arthur Cecil Pigou used this axiom in 1928 to define tax progressivity. The violation of Principle 1 automatically entails the violation of Principle 2. If Principle 2 holds, then Principle 1 will always be satisfied.

Principle 3: xi ≥ xj and ti ≥ tj and ti/xi ≥ tj/xj → xi — ti ≥ xj — tj for all i and j.

If Principles 1 and 2 are satisfied, then Principle 3 implies that the post-tax income must increase monotonically as pre-tax income increases. This principle ensures that tax must not make the richer person poorer and poorer person richer. This principle can be violated when richer individuals pay so much tax that they become poorer. In other words, the tax should not change the rankings of individuals in pre-and post-tax income distributions.

The violation of three basic tax principles provides the three sources of inequity. The breach often occurs due to non-compliance of the tax code. Also, some countries may have tax codes that may contribute to violations.

Since the introduction of progressive income tax, many governments’ fiscal policies have included the redistribution of income as an important goal. This blog proposes a measurement system, according to which violation by an income tax system of each of the three equity principles would negatively influence the redistribution effect of the tax. These negative influences provide a means to characterize the inequities present in an income tax system and assess their significance.

The blog offers an international comparison of inequity in taxation in nine developed countries. The income distribution data for nine countries were obtained from the Luxembourg Income Study (LIS) database for 2013. Gross household income is the total monetary and non-monetary current income. Disposable income is the gross income net of taxes and social security contributions. Thus taxes include both income tax and social security payments.

We equalized household incomes and taxes (including social security payments) by dividing them by the square root of the number of household members. This equalizing procedure accounts for different needs of household members and economies of scale that occur in larger households.

The redistribution effect of the tax is measured by the percentage change in the pre-and-post Gini index.

How does the violation of inequity principles affect inequality?

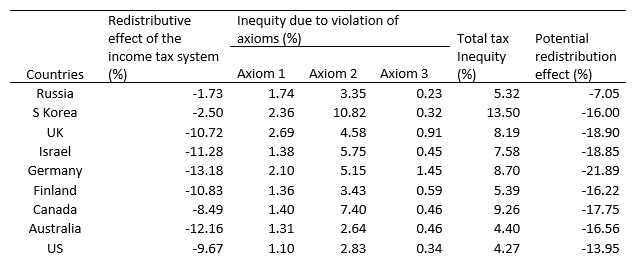

Table 1 reveals that the Australian income tax system reduces inequality in living standards by 12.16 percent. The inequity due to violation of equity principle 1 reduces the overall redistribution effect by 1.31 percent. The violation of this principle implies that some more affluent taxpayers pay lower income tax than some poorer taxpayers.

Table 1: Inequities in Taxation: International Comparison

The inequity due to breach of equity principle 2 increases income inequality by 2.64 percent. This implies that richer individuals pay income tax at a lower rate than poorer individuals in some cases.

The inequity due to violation of equity principle 3 reduces the overall redistribution effect by 0.34 percent. This principle relates to horizontal equity, implying that the tax system changes the rankings of individuals between the pre-and-post tax income distributions. The rank change happens because the tax system makes some poorer individuals richer and the more affluent individuals poorer. It also means that the tax system does not treat taxpayers with the same economic circumstances equally.

The total inequity in the Australian tax system reduces the redistribution effect of tax by 4.40 percent. Our results suggest that in the absence of these significant inequities, the Australian tax system could have reduced income inequality by 16.56 percent (instead of 12.16 percent). Thus, the removal of inequities could improve taxation’s redistribution effect without increasing marginal tax rates on higher-income groups.

So, where does Australia stand relative to other advanced countries?

Table 1 makes informative comparisons of tax systems between nine advanced countries. The USA has the lowest inequity index of 4.27 percent, while Australia has the second-lowest inequity in its income tax system at 4.40 percent. The inequity is the highest in South Korea at 13.50 percent, followed by Canada at 9.26 percent.

The violation of tax equity principle 2 has the most severe impact on the redistributive effect in all nine countries. This is a striking finding, suggesting substantial regressivity in the income tax systems of all countries. The inequity is much smaller if the tax system requires that wealthier taxpayers pay more tax, but inequity increases significantly when the system requires them to pay tax at higher rates. Thus, the progressive income taxes induce the taxpayers to indulge in tax avoidance or even tax evasion schemes.

Conclusion

This blog has delineated three distinct types of inequity, which may be present in an income tax system employing three fundamental principles of equity. More generally, the measures of inequity can be used to make informative comparisons of tax systems between countries, or regions, or demographic groups, or overtime. They can also guide tax reforms, as demonstrated. The removal of inequities can improve the tax system’s redistributive effect without changing the marginal tax rate structure, which governs incentives.

I thank Jing-hi for her help in calculations presented here.

But why the square root? Four people cost more than two to maintain. More generally what about voluntary transfers between households? A high income son supporting aged parents may not be as well off as an individual not so doing on an apparently lower income.