While many countries use tax-related whistleblowing programs, the direct effect of these mechanisms is usually negligible (approximately, 0.05% in the US, and even less than that in the UK). The small direct effect of whistleblowing programs on tax revenues, combined with the negative social externalities and the possibility of false reporting, raises a question about their overall effectiveness.

However, to consider the overall effectiveness of whistleblowing programs, one must also consider the indirect effect of whistleblowing—deterrence. When every citizen could become an agent of the tax authority, deterrence from tax evasion increases significantly.

Whistleblowing hotline in Israel

In our study, we examine whether tax collections increased after the initiation of the “Justice Hotline”, a whistleblowing mechanism introduced in Israel in February 2013. The Justice Hotline provides an interesting setting to test the indirect effect of whistleblowing on tax collections, for two reasons. First, the initiation of the Justice Hotline was followed by a large media campaign meant to create deterrence. Second, in hindsight the direct tax collections from the Justice Hotline were insignificant.

The State Comptroller of Israel, who audited the Justice Hotline, reported in October 2014 (18 months after the initiation of the program) that the Tax Authority of Israel did not have adequate personnel to efficiently process and use information from whistleblowers, and had collected negligible tax amounts based on whistleblowers’ tips. Thus, the increased tax collections observed around the initiation of the Justice Hotline can be mostly attributed to an increase in deterrence.

To assess the overall effect of the whistleblowing mechanism (direct and indirect) on tax revenues, we consider two events. The first is the initiation of the Justice Hotline in Israel in February 2013, which the public did not expect. The second is the period in which the public became aware that the direct effect of the whistleblowing program was insignificant. We obtain data on monthly income tax collections from the Tax Authority of Israel for the period from 2008 to 2016.

In addition, we obtain monthly income tax collections by industry and collections from corporations and employees. As in other countries, the Tax Authority of Israel requires individuals and corporations to file annual income tax returns and pay the taxes due. Many individuals who only receive salaries up to a certain limit are exempt from filing, because the employer deducts their income tax at source.

Different effects on corporations and employees

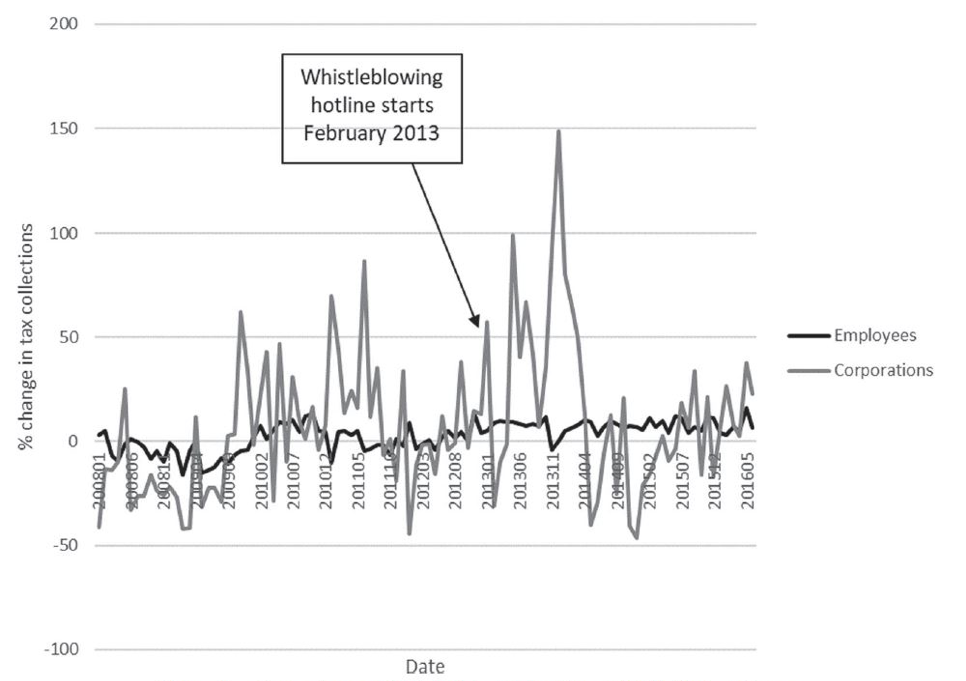

We find a significant increase in tax collections immediately after the initiation of the Justice Hotline in February 2013 (See Figure 1). The whistleblowing initiative received considerable media coverage and public attention, and apparently created deterrence. A statistical analysis that compares tax collections from corporations and employees supports the claim that tax collections increased following the Justice Hotline.

Note that employers deduct income tax from employees, whereas corporations have more discretion on the timing and amount of tax payments. Hence, whistleblowing should have a larger effect on income tax collected from corporations than on the income tax collected from employees, which is what we find.

Figure 1: Change in tax collections from corporations and individual employees

In addition, we obtain data from the Tax Authority of Israel on income tax collections in 21 industries. We divide the industries into those that are more prone to tax evasion and those that are less prone to tax evasion. The division was based on discussions with the Tax Authority of Israel and based on their experience.

We find the increase in tax collections occurred only in those industries more prone to tax evasion. Collections, however, did not increase in the control industries that are less prone to evasion. These findings support the claim that the initiation of the Justice Hotline served as a deterrence mechanism, resulting in an indirect increase in tax collections.

In addition, we find the effect of the Justice Hotline on tax collections was temporary. The State Comptroller of Israel and the press revealed in 2014, about a year after its initiation, that the new whistleblowing mechanism was ineffective in processing and acting on whistleblowing events. We find a decrease in tax collections after the ineffectiveness of the Justice Hotline became public. Moreover, this decline in tax collections occurred in collections from corporations, much less from employees, which is consistent with the claim that the deterrence effect of the Justice Hotline diminished following the report of the State Comptroller of Israel.

Prior studies examine the deterrent effect of whistleblowing on tax evasion in controlled laboratory experiments. These studies estimate that whistleblowing mechanisms could increase tax revenues from about 38% to more than 77%. Our empirical findings are consistent with these experiments.

Whistleblowing serves as a deterrent not only with tax evasion, but also in other regulatory environments. For example, the US Sarbanes-Oxley Act of 2002 (“SOX”) requires all publicly traded corporations to establish procedures for employees to file internal whistleblower complaints and to establish procedures aimed at protecting employees who file allegations with the audit committee of the firm. Our study suggests whistleblowing deters corporations from engaging in tax evasion and increases compliance with the payment of taxes. Whistleblowing mechanisms in other contexts may have a similar deterrence effect.

Policy options

Whistleblowing is not the only mechanism to deter non-compliance. For example, direct enforcement activities of the IRS Criminal Investigation Division deter tax evasion and increase taxpayer voluntary tax compliance. In addition, governments may require public disclosure of tax filing. Research in Norway shows that public disclosure of tax filings reduces tax evasion. Specifically, reported income of business owners in Norway increased after the government started posting tax filings online, suggesting public disclosure of tax and income information reduces tax non-compliance due to a deterrent effect.

Research also shows that tax evasion is lower for income subject to third-party reporting than for self-reported income. For example, employers often report the income of their employees, and for such third-party reported income, tax evasion is close to zero.

The evidence in our study is consistent with these findings. In particular, we show whistleblowing increases tax collections from corporations, which self-report their income, and have little or no effect on tax collections from employees, who are subject to third-party reporting of income.

This piece is based on Eli Amir, Adi Lazar & Shai Levi (2018), ‘The Deterrent Effect of Whistleblowing on Tax Collections’, European Accounting Review, DOI: 10.1080/09638180.2018.1517606

Recent Comments