At the time of last year’s budget, I wrote a blog post[1] revealing how neither the Government’s nor the Labor Party’s then proposed tax changes would simplify the personal income tax system or offer genuine long-term reform. This was largely because of continuing misrepresentation of the tax scale and failure to take into account how the means-tested Low Income Tax Offset (LITO) and the new Low and Medium Income Tax Offset (LMITO) actually work. The same criticism can be made about the Government’s latest versions of its legislated and proposed tax changes over the next five years.

But, notwithstanding the dangers of legislating now a Stage 3 tax regime to apply from 2024-25 when there is no way of knowing the economic or fiscal context in which it would occur, it may be possible to build on Stages 1 and 2 (for 2019-20 and 2022-23, respectively) a third stage that genuinely simplifies the scale and provides a permanent constraint on bracket creep without unduly hurting future revenues. A future government might wish to go further, but that should wait until a clearer picture of the likely prevailing context is available.

The Government’s tax cut plan: Stages 1 and 2

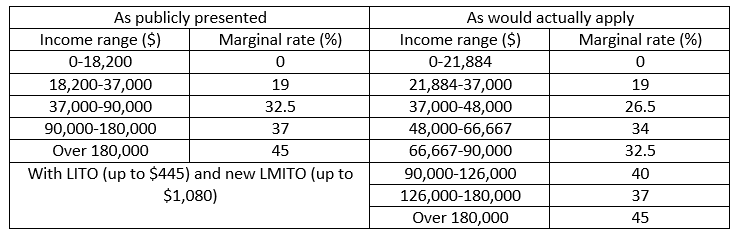

Table 1 shows the proposed 2019-20 (Stage 1) scale as publicly presented and as I believe it would actually operate given the impact of LITO and LMITO.

Table 1: 2019-20 Personal Income Tax Scale

In effect, the actual basic tax threshold will increase around 6.5% from the previous actual level (after LITO), and the point at the top of the 32.5% step will increase just over 3% to $90,000. However, there will be no direct adjustment of the other tax points to address bracket creep (though the LMITO provides tax cuts beyond what indexation of the other tax points would deliver to most middle income earners).

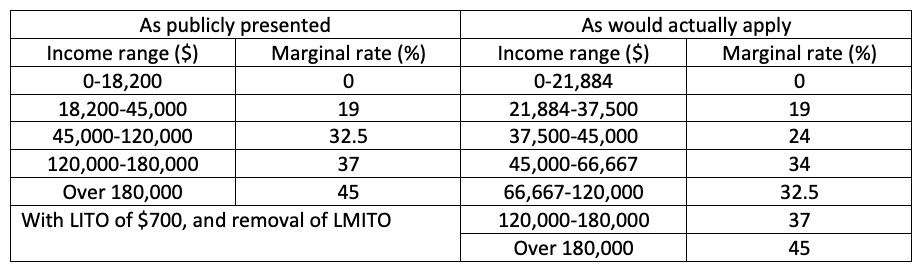

Table 2 similarly shows the proposed 2022-23 (Stage 2) scale as publicly presented and as I believe it would actually involve.

Table 2: 2022-23 Personal Income Tax Scale

Editor’s note: On 11 July 2019, a correction was made to the income ranges and marginal rates in this Table, as would actually apply.

While this would remove the complexity of the LMITO, the increased LITO and its complex withdrawal arrangement still leaves an overly complex structure overall. The increase in the point at the top of the 19% step (from $37,000 to $45,000) demonstrates that the impact of the bracket creep that might otherwise have occurred from 2018-19 for most taxpayers will generally have been avoided, essentially by locking in the former LMITO tax cut and extending it across all higher income groups. The increase in the point at the top of the 32.5% step (from $90,000 to $120,000) likewise more than compensates for any bracket creep that might otherwise have affected high income earners, even though the point at the top of the 37% step will not be adjusted. Importantly however, the failure to increase the basic threshold means very low-income earners receive no compensation for the bracket creep since 2019-20. That is, these low-income earners are likely to face increased tax as a percentage of their real incomes.

So, arguably, Stage 2 represents a modest improvement – slightly less complex and addressing bracket creep for most taxpayers – without excessively favouring high income groups (though it should have offered more to those on very low incomes). As the ANU Centre for Social Research and Methods revealed in April, Stages 1 and 2 of the Government’s tax proposals keep average tax rates pretty steady as incomes grow over the period to 2023-24.

Problems of Stage 3

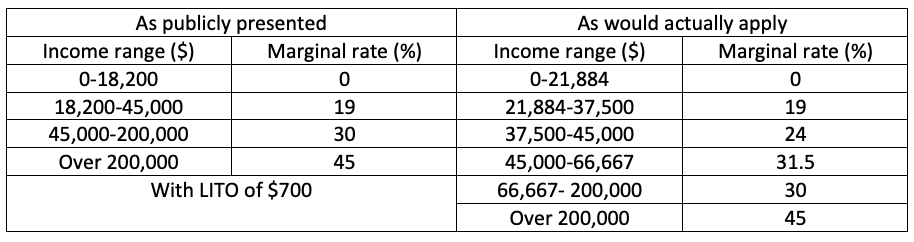

It is Stage 3, which is of concern for several reasons. First, as Table 3 shows, it provides no further improvement in terms of simplicity, continuing to rely on the means-tested LITO rather than just increasing the basic threshold directly.

Table 3: 2024-25 Proposed Personal Income Tax Scale

Editor’s note: On 11 July 2019, a correction was made to the income ranges and marginal rates in this Table, as would actually apply.

The Stage 3 proposed scale also benefits only those on incomes above $45,000, the benefits at higher incomes far exceeding the compensation justified for bracket creep. Moreover, there is no compensation for bracket creep at and below $45,000, meaning these taxpayers are likely to face further increases in their average tax rates.

Bearing in mind the revenue implications of Stage 3 and the uncertain economic and financial context when it would come into effect, it is understandable that many critics are calling for it to be set aside for consideration after the next election due in 2022.

On the other hand, simply continuing with the Stage 2 scale with no indication of whether or how bracket creep might be addressed into the future, or whether there are any plans for genuine reform to simplify the scale, may equally be criticised.

An alternative proposal

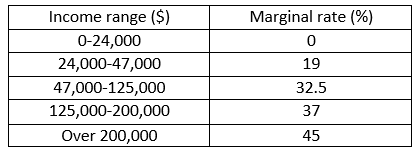

An alternative Stage 3 which the Parliament might like to consider would be to simplify the Stage 2 scale with minimal additional distributional impact and to index the scale both to 2024-25 and by legislation into the future. Arguably, the indexation factor should be based on movements in earnings, but perhaps a more conservative approach could be pursued for now by using the Consumer Price Index or CPI (as the Fraser Government did – if briefly – in the 1970s). Assuming around 2% annual increases in the CPI, and applying this from whenever the relevant tax point was last adjusted, this suggests a scale in 2024-25 something like Table 4.

Table 4: Possible alternative 2024-25 tax scale (as should be presented and applied, with no LITO)

The legislation could then require indexation of these tax points into the future by movements in the CPI.

As the Prime Minister has stated, there could be further benefits if the scale were further simplified by reducing the number of steps, so that the vast majority of taxpayers faced the same marginal tax rate. But as the Henry Report recommended (and the Fraser Government demonstrated back in 1978), such a move requires a significant increase in the basic tax threshold if the distributional impact is to be widely accepted. Indeed, a hefty increase in the basic threshold would allow much better integration with the social security system as Henry advocated. Moreover, any standard marginal rate would almost certainly have to be more than the 30% the Government proposes to make it both affordable and acceptable in terms of the distributional impact. In any case, I suggest that be a matter for more careful consideration at a more appropriate time (in other words, after the next election).

Of course, all the above is based on my assumption that simplicity remains one of the core principles of good tax and transfers design (along with efficiency and equity). While Henry and other genuine reform advocates might agree, the professional political (and media) perspective seems to focus purely on immediate winners and losers, regardless of complexity or how people’s behaviour might be affected.

Tax and transfer system has become too complicated to understand

The fact is that the tax and transfer system has become mind-bogglingly more complex over the last 20 years with the personal income tax scale being just one element (and even the above ignores the Medicare levy, the Seniors and Pensioners Tax Offset, etc.). It is nigh on impossible for Australians to understand how the eligibility rules and means tests for family allowances, childcare subsidies, housing assistance or private health insurance work, let alone how they interact with each other and the tax system.

Does this matter? Surely it must if people are to make informed judgments without the cost and trouble of seeking specialist advice from bureaucrats or the growing industry of private advisers, and if the policies are to encourage desired behaviours such as to work or save.

[1] ‘This is not a Genuine or Equitable Way to Simplify the Personal Income Tax System’, Austaxpolicy Blog, 22 May 2018. I recognise now there were some errors in my calculations but the basic picture presented was accurate.

An interesting post, thank you.

But the suggested alternative stage 3 proposal does not take account of the stated objective to have the personal tax rate for middle/working Australia aligned to the corporate tax rate. I understood this desire/concept, echoing from the Keating era, is a way of countering the desire of people to incorporate and bring themselves into the company tax regime, complicating their affairs and the tax system.

This is an attraction of the Stage 3 marginal rate of 30% which is at least closer to the small company tax rate?

Further, if the stage 2 marginal-rate step from the middle/working Australia rate of 32% to 37% is at $120,000, and one indexes that, should not the stage 3 threshold from the middle rate be at an income higher than $125,000, say $150,000?

As you note the unhealthy focus purely on immediate winners and losers distorts the simplification objective.

The 2017-18 scale had the 37% rate starting at $90,000. Indexing that to 2024-25 raises it to about $110,000, which is what my calculations involve The Albanese proposal is to have that point at $135,000, hence the largest gains are at $135,000 (see Graph1)..

I have not discussed the argument about tying the top marginal rate it the corporate tax rate. I am not convinced of the merits involved, but the standard marginal tax rate I have indicated support for (with a suitable tax threshold) would be between 30 and 35%.

Andrew

Pingback: Albanese’s Proposal Doesn’t Fix Bracket Creep at the Bottom End, More Work Is Still Needed - Austaxpolicy: The Tax and Transfer Policy Blog