When designing social security policies and programs which deliver government payments to individual claimants, governments have a choice as to whether they make eligibility for payments more or less burdensome. In their work on Administrative Burden: Policymaking by Other Means, Pamela Herd and Donald Moynihan explain that processes put in place to access government resources are often burdensome, with ‘learning costs’, ‘compliance costs’, and ‘psychological costs’ for claimants. These costs can weigh heavily on those needing access to resources. For people experiencing socioeconomic challenges the burdens are often particularly heavy. In the context of the welfare state, such costs or burdens play a key role in the accessibility of social security, and also have a significant impact on the dignity and autonomy of claimants.

This blog examines these issues in the context of the Cashless Debit Card (CDC), drawing upon my recent article in the Australian Journal of Public Administration. Australia has been experimenting with cashless welfare cards for many years, commencing with the BasicsCard as part of the 2007 Northern Territory Emergency Response. Then following with the CDC, which was implemented in 2016.

The policy rhetoric underpinning these programs is that social security recipients need external constraints imposed on them to prevent them from engaging in irresponsible purchasing patterns regarding a range of goods: alcohol, tobacco, gambling products, and pornography in terms of the BasicsCard, and alcohol, gambling products, and some gift cards in terms of the CDC. Pushing people from welfare into work has also featured prominently in dominant policy discourse.

My research shows that while cashless welfare card programs are publicised by governments as effective support mechanisms for people in need of social security, both cards have led to significant problems for cardholders in terms of managing their finances, purchasing what they need when they need it, and shame.

Burdens in securing essentials and managing social security income

People receiving social security payments already face the challenge of paying for essentials on low incomes. However, administrative burdens imposed through the CDC can add to their troubles. CDC holders in the original sites where the card was implemented generally have 80 per cent of their fortnightly payments restricted to the card, unless they have been able to obtain a reduction in their restricted payment percentage through an application to a community panel. CDC holders in the Northern Territory have 50 per cent of their income restricted to the CDC.

Numerous CDC holders have reported difficulties in navigating the burdens imposed by the program when they need to spend their social security income. The types of difficulties people on the CDC can experience when trying to spend their social security payment include:

- technology failure due to power outages;

- technology failure due to the financial services provider payment system;

- payment delays for bills due to the financial services provider processes and subsequent fees incurred due to these late payments;

- merchants and service providers refusing to accept the card;

- cardholder error entering their CDC personal identification number; and

- insufficient funds in the cardholder’s account to make the purchase.

The issue of insufficient funds can be related to difficulties in accessing their CDC balance, which requires consistent access to expensive non-government subsidised technology (for example, mobile phones, computers, data packages for internet connection).

The CDC imposes technology burdens on program participants – these are ‘compliance costs’ social security recipients on the CDC are expected to carry in exchange for their payment. However, it is important to reflect on the impact of de-facto technology tests built into the digitalisation of the welfare state, as these can have an exclusionary impact on people experiencing poverty.

There are also significant CDC ‘learning costs’. These include:

- learning the CDC terms and conditions;

- checking to see whether a particular merchant or service provider accepts the CDC (there are plenty that do not who are not selling alcohol, drugs or gambling products);

- if the merchant or service provider does accept the CDC, checking to see their system is not down before trying to make purchases;

- for those unfamiliar with internet banking, learning how to log on to the internet and manage bill payment online.

These learning costs can weigh heavily on social security recipients who also have time burdens imposed through other welfare conditionality programs.

The Commonwealth Government emphasises that the CDC ‘can be used online and at markets or anywhere else which offers purchases using an EFTPOS machine.’ However, many people have found the CDC more restrictive – with constraints extending beyond items that were meant to be prohibited expenditure categories. Difficulties purchasing groceries, car insurance, vehicles, second hand goods, and health needs have been reported since the commencement of the program.

Research indicates that CDC holders have endured hundreds of thousands of failed transactions. Transaction failures represent the loss of capacity of CDC holders to access consumer goods and services at the time when these are needed.

Government commissioned research undertaken in Ceduna, the East Kimberley and the Goldfields discovered that 50 per cent of cardholders found that it was harder to manage their money once they had been put on the CDC, and 52 per cent found it harder to save money once they were put on the CDC. These are concerning CDC ‘compliance costs’ for cardholders.

Time and psychological burdens of cashless welfare cards

In terms of time burdens, the CDC involves time lost trying to sort out technology failures, transaction failures, and repeated attempts to pay for the goods or services. Those on the CDC who encounter delays in their bill payments due to technology issues and financial services provider processes can also experience the burden of a reduced credit rating.

In terms of ‘psychological costs’, government commissioned research reveals that CDC holders experienced ‘a large decline in the level of autonomy and control’ and the majority reported ‘feelings of discrimination, embarrassment, shame and unfairness as a result of being on the Card’. In addition, the CDC imposes the psychological cost of mandatory visibility as to socioeconomic status when people are engaging in consumer activity.

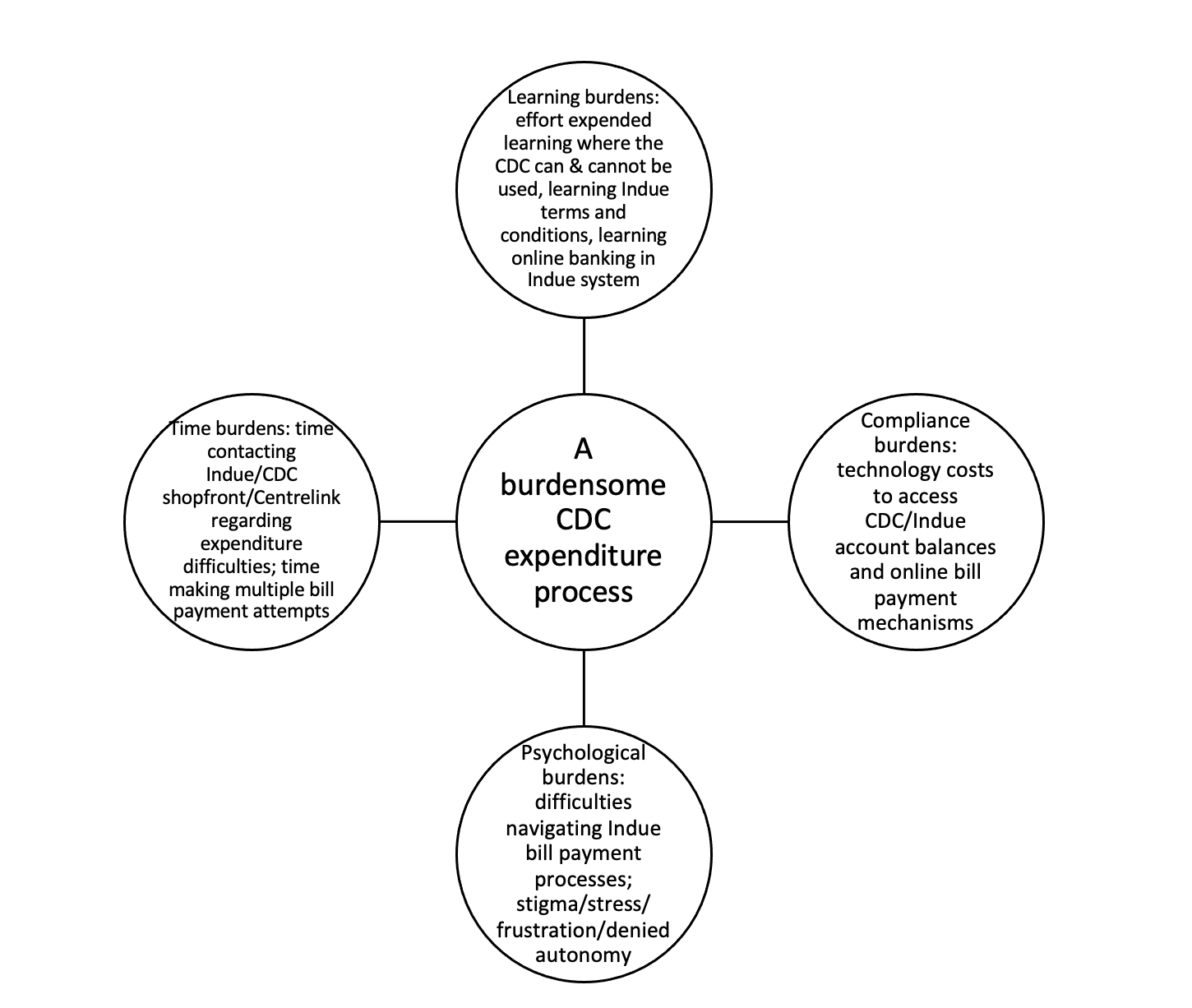

The heavy burdens embodied in the CDC expenditure process are represented in Figure 1, where people on the program can experience one or a combination of these burdens at any given time.

Figure 1: A Burdensome CDC Expenditure Process

The long-term effects of such burdensome processes across the compulsory cohort of cardholders are yet to be seen, however the short-term effects include adverse impacts on health and wellbeing.

Conclusion

The CDC imposes significant burdens – ‘learning costs’, ‘compliance costs’, and ‘psychological costs’ – on people receiving social security payments. These costs are a consequence of an overall welfare conditionality project that builds disincentives to claim government income support into the structure of the social security system. Cardholders experience heavy compliance and administrative burdens in securing essentials and managing their social security income using the CDC. Evidence suggests that numerous people in need of social security who have been forced on to the CDC would benefit from a reduction in burdensome processes. This would be facilitated by designing systems that are autonomy enhancing, respectful of the human dignity of claimants, and fairly easy to navigate.

There is also a financial burden. Indue prescribes where recipients can spend their money, no longer can people shop at the local markets and even their local stores. They can shop only at approved merchants either Woolworths Coles or Aldi.

There are bank transaction fees that are placed on the card holder. So not only do they have to buy more expensive food they also have to pay a bank fee. Every time the card declines there is an “ insufficient balance” fee placed on that transaction.

There is also a health burden where through stress recipients are exposed to new medical issues.

With the recent changes in Medicare and the additional costs imposed for many medications and treatments this will cause people to make a decision between having food to eat or continue being sick and at risk of real and health compounded issues or even death.

This is a significant problem which is just emerging as there is no list to be found in a public forum where people can check to see which medications have been removed and which medications are no longer on the PBS. For example the shingles vaccination which was bulk billed is now somewhere up to $300.

These issues when combined add to the burdens identified in your article. The changes to Medicare will certainly impact on financial decisions.

There are other burdens as local and state governments will have to find ways to support the increase in homeless people, emergency accommodation, safe houses for DV protection, police intervention, emergency department treatment.

The Indue Card stresses family relationships, especially if there is one or more people addicted to drugs, alcohol and gambling. The moment they are placed on the card they are effectively going into “cold turkey mode” without any support. This creates volatile situations and puts the whole family at risk. The stress the card puts on people creates shame and hopelessness and result in feelings of worthlessness and can lead to suicide.

There needs to be exposure around the relationship between the LNP and Indue and their political donors donor such as the big four banks, major retailers.

Just imagine the size of the donations the LNP receive from the JobKeeper Mates, should they decide to express their gratitude to Scomo and his co-conspirators.

Question, may use quotes from your article to use in a newsletter and a link to your full article.

Regards Kathy Manifold

Thankyou kindly for your interesting comments and your interest in my blog Kathy. Yes of course feel free to use quotes from my article in a newsletter, and if you would like to email me at [email protected] I am happy to share the longer article with you on which my blog was based. That article analyses further burdens created under the CDC program for cardholders. I am not sure whether you have seen the website for my Discovery Project Hidden Costs report, but that may also have material that is useful for your newsletter: https://www.incomemanagementstudy.com/blog/hiddencosts

I can’t believe the problems these cashless cards are already causing and if life on centrelink payments isn’t hard enough now things are only going to get a lot worse especially for families. And all the conditions you can only shop at Coles Woolworths & Aldi you’ve got to pay bank fees if there’s not enough funds on the card what the hell is wrong with you people at centrelink? Are you trying to make more people commit suicide you all should be discussed with yourselves.

This seems to be just another LNP privatisation rort whereby Peoples constitutional right to social security has somehow been corrupted & commodified by this questionable unconstitutional arrangement with Twiggy & his Minderoo Foundation.

Many would appreciate a systemic/structural legal analysis of its validity.

Thankyou for your comments Gail. I have a legal background and have taught constitutional law. The Australian Constitution gives the Federal Government broad lawmaking power with respect to social security under sections 51(xxiii) and (xxiiiA). If there were to be a high court challenge as to the legality of the cashless welfare card parts of the Social Security (Administration) Act 1999 (Cth), Part 3B (BasicsCard) and Part 3D (Cashless Debit Card), I think it likely they would be held to be within the powers of the Federal Parliament. Of course there are valid policy arguments to be made about the futility, and indeed cruelty, of punishing individuals for structural problems that generate unemployment and underemployment.

Shelley Bielefeld

Thank you for clarifying the legislative map or structural basis that enables this administrative arrangement to continue as it has & for recognising & respecting “the futility, and indeed cruelty, of punishing individuals for structural problems that generate unemployment & underemployment.”