The 2025 Report of the Economic Inclusion Advisory Committee (EIAC), released on March 11, provides a new analysis of the effectiveness of recent increases in Commonwealth Rent Assistance (CRA) in alleviating housing stress among Australians on low incomes.

Understanding CRA

Commonwealth Rent Assistance (CRA) is a supplementary payment available to tenants receiving social security benefits who do not live in public housing.

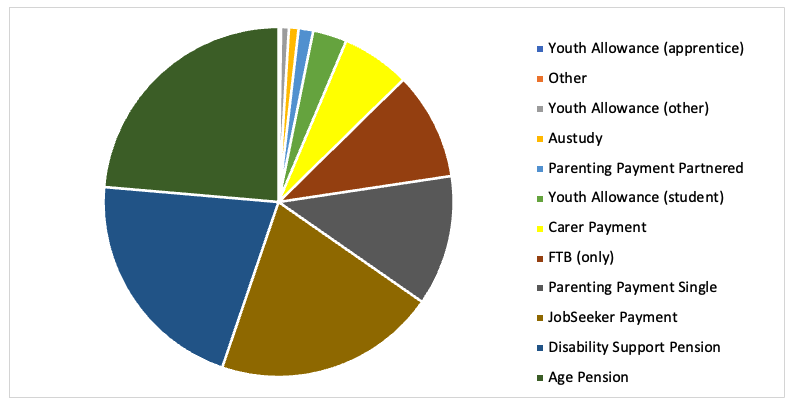

Around 1.3 million households received CRA in September 2024. Of these, about 75% were recipients of the Age Pension, Disability Support Pension, JobSeeker Payment, or Parenting Payment Single. Around 10% were families who were not on income support but were receiving the Family Tax Benefit.

Figure 1: Households receiving Commonwealth Rent Assistance by payment type, September 2024

Source: Expanded DSS Benefit and Payment Recipient Demographics – September 2024

There is a minimum fortnightly rent threshold that varies between singles and couples. For example, a single person on JobSeeker Payment does not receive any CRA until their rent exceeds $149 per fortnight, which is about 19% of their basic payment rate.

Once the rent surpasses this threshold, CRA increases by 75 cents for every dollar of rent paid, up until the maximum CRA is reached. However, these maximum levels remain modest, ranging from $140 per fortnight for a single person sharing accommodation, $199 per fortnight for a couple, and $211 per fortnight for a person living alone.

For context, a single person on JobSeeker Payment living alone who receives the maximum level of CRA would be paying 43.5% of their total payments on rent. This leaves them with just under $40 per day to cover all other living expenses such as food, healthcare, clothing, transport, and other essentials. For reference, the current JobSeeker payment rate for a single person is $778 per fortnight, and a single person living alone receiving the maximum CRA would pay at least $430 per fortnight in rent.

In the 2023-24 Budget, the Government increased the maximum rates of CRA by 15%, followed by another 10% increase in 2024-25. Since March 2022, the maximum CRA rates have risen by about 45%, including regular indexation every six months. Additionally, the government raised the base rates of JobSeeker and Youth Allowance by $40 per fortnight in September 2023. They also introduced more significant increases in payments for lone parents and the older long-term unemployed individuals.

What is housing stress?

The Australian Housing and Urban Research Institute (AHURI) defines “housing stress” as a situation where a household in the bottom 40% of Australia’s income distribution spends more than 30% of its income on housing costs. The assumption underlying this definition is that households with higher incomes who spend more than 30% of their income on housing typically do so voluntarily, and this spending has less of an effect on their ability to afford other necessities.

According to the most recent data from the ABS Survey of Income and Housing in 2019-20, 91% of households whose principal income is derived from government pensions and allowances are in the bottom 40% of the income distribution. These households account for more than half of all households in the lowest 40%, meaning that individuals on social security pensions and allowances are likely to meet the criteria for housing stress, contributing to a significant proportion of the overall population experiencing it.

Trends in housing stress for CRA recipients

The EIAC Report analysed trends in housing stress for CRA recipients, particularly focusing on the percentage of households paying over 30%, 40%, or 50% of their income in housing costs. These numbers, which are calculated by the Department of Social Services, includes all forms of income received by CRA recipients, not just social security payments.

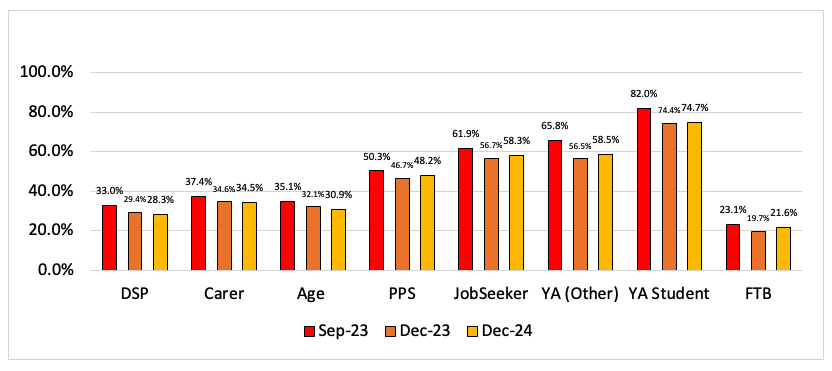

The Department of Social Services releases quarterly data on CRA, and the effects of CRA rate increases in September 2023 and September 2024 will first be visible in the data from December. Overall, housing stress at the 30% threshold is estimated to have declined for all major payment recipient groups between September and December 2023, as illustrated in Figure 2.

Figure 2: Percentage of group experiencing rental stress (30% level) by category of payment, September and December 2023 and December 2024

Between September and December 2023, the proportion of CRA households paying more than 30% of their income in rent decreased from 42% to 39%. This marked the first time since June 2022 that rental stress fell below 40%. Similarly, the share of households paying more than 40% of their income in rent dropped from 26% to 23%, while those paying over half of their income on rent fell from 16 to 14%.

Although the share of households experiencing rental stress increased after December 2023, it declined again between September and December 2024, following the latest CRA increase.

Rental stress remains particularly high among Jobseeker recipients due to the low base payment, and it is especially pronounced for Youth Allowance recipients and students. Rental stress is also more prevalent among those without children, likely reflecting that households with children tend to have higher incomes, often from working parents, compared to those reliant on income support.

Limitations of the analysis

Changes in rental stress result from a complex interplay of factors, including increases in base payments (such as JobSeeker) and CRA, along with fluctuations in rent levels and changes in the demographic composition of payment recipients.

Each quarter, new recipients “flow onto” payments while others exit. For instance, Youth Allowance recipients (students) tend to finish their studies between September and December, leaving the payment system, which reduces the overall measured rental stress in December. However, students account for less than 5% of all CRA recipients.

It is difficult to quantify the relative impact of each factor, but reasonable estimates suggest that about two-thirds of the reduction in rental stress is due to the base rate increase of JobSeeker and related payments, with the remaining one-third attributed to the CRA increase in 2023. The drop in rental stress observed in 2024 is more likely due to the increase in CRA.

The report also explores rental stress “without CRA”, calculating the share of households paying over 30%, 40%, and 50% of their income on housing costs if CRA is excluded from their total payments. Without CRA, over 70% of recipients would spend more than 30% of their income on rent, 45-50% would pay more than 40%, and around 30% would pay more than 50%.

Despite widespread reports of rising rent costs, there was little change in rental stress “before CRA” during this period. This may suggest that while rent increases exacerbate stress for those already struggling, they do not necessarily push more people into rental stress.

Conclusions

The EIAC report underscores that increases in CRA significantly enhance its effectiveness in reducing rental stress. Base payment increases, such as those for JobSeeker, also help alleviate stress. The report’s top recommendation is to substantially raise the base level of JobSeeker and related payments, and it stresses the need for further increases in CRA to prevent a regression in housing affordability.

However, this analysis focuses solely on rental stress in monetary terms. Households on income support or family payments, even if not in rental stress, may still face significant housing challenges. They may live in lower-quality housing, further from essential services, or in more crowded conditions. These factors, which can contribute to poor living conditions and health risks, are not captured in the current analysis.

Given these broader housing challenges, there is a need for further research to address the full scope of housing issues faced by low-income households. While the government’s improvements to CRA are commendable, the situation remains troubling. As of December 2024, more than 200,000 CRA recipients (15% of total recipients) were spending over half their income on rent. This indicates that more action is urgently needed to address the growing housing affordability crisis.

Recent Comments