Days before the 2025 federal budget, the Australian Government have released a Statement on Developing an Innovative Australian Digital Asset Industry. At the same time, the government also released the Board of Taxation’s final report on the Tax Treatment of Digital Assets and Transactions in Australia. It is the latter that is of particular interest to the tax profession and those participating in the crypto economy. This article provides a high-level overview of the board’s recommendations.

Board of Taxation report

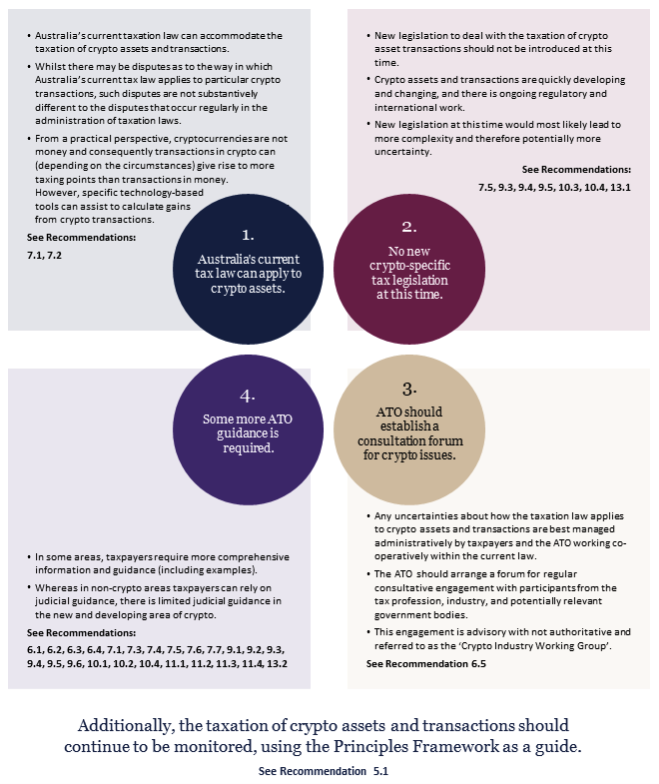

Fundamentally, the key message from the report is that existing tax law broadly covers the activities occurring within the crypto-economy. As such, no new specific legislation is required just yet. Instead, any uncertainty can be managed by the Australian Taxation Office (ATO) by providing more guidelines along with a bespoke working group to facilitate ongoing considerations and consultations.

The board, an advisory body, sums up their report as follows:

Source: Board of Taxation Final Report, page 4.

Notably, the board recognises increasing adoption and growth in the crypto-economy (Observation 2.1) and that the ecosystem is complex and evolving quickly (Observation 3.2). Such a mix requires clarity and certainty in the application of current tax laws for taxpayers to be compliant with their tax affairs.

While there is ongoing debate within the legal profession over whether crypto assets are property, the board takes a position to assume crypto assets are property (Observation 4.1). It notes that if this position is found to be incorrect, the government may need to revisit the issues raised in the report.

The board also reaffirmed its support for the 2022 amendment to the foreign currency definition in Australian tax laws to prevent Bitcoin from being classified as such (Observation 4.2). This ensured the status quo under TD 2014/25 would remain.

Relevant to the critical role of tax practitioners, the board recognised the skills needed to advise in this space and the overall need for education and awareness for both tax practitioners and taxpayers, particularly given the lack of general community awareness (Observation 6.1). The board highlights a balance must be struck between personal responsibility and meeting tax obligations (Observation 11.1).

Practical uplifts to ATO guidance

The board presented some practical recommendations for the ATO to consider in its focus on guidance and support on its website.

In brief, the board recommends:

- publishing an index of all crypto asset related content (Recommendation 6.1);

- including statements of target audience and links to other guidance on the same topic (Recommendation 6.2);

- including detail as to the legislative or common law precedent relied upon (Recommendation 6.3); and,

- provide a published history of earlier versions of guidance to enable changes to be identified (Recommendation 6.4).

Ultimately such changes would improve the navigation of ATO guidance, overcoming some of the issues faced with evolving web-guidance, as well as making explicit the link between the law and the ATO’s interpretation of the law.

The development of a crypto industry working group

As noted, the board recommended the establishment of a working group to continue consultation and engagement (Recommendation 6.5). Many of the observations and recommendations detailed in their report are ultimately directed towards such a working group. Thus, rather than the board suggesting explicit treatment, it defers any specific interpretation of tax implications to such a group to consider at a later point in time.

Building on Recommendation 6.5 are a range of issues identified. Such recommendations relate to, for example:

- indicia for carrying on a business (Recommendation 7.1);

- isolated profit-making undertakings / disposals of crypto assets on revenue account where the assets are not trading stock (Recommendation 7.2);

- practical costing solutions (Recommendation 7.3);

- personal use assets (Recommendation 7.4);

- taxation of financial arrangements (TOFA) rules (Recommendation 7.5);

- source of income (Recommendation 7.6);

- valuation guidance (Recommendation 7.7);

- mining activities (Recommendation 9.1);

- staking/validating (Recommendation 9.2);

- airdrops (Recommendation 9.3);

- bridging/wrapping (Recommendation 9.4); and,

- Goods and Service Tax (GST) responsibilities for non-fungible tokens (NFTs) (Recommendation 10.2).

More guidance will reduce uncertainty

The board received clear feedback on the challenges, including the inability to comply with obligations, however the board concluded that new legislation may not be the answer.

Irrespective of what aspect of the crypto economy was examined, a clear message coming through the board’s report is that more guidance, or updating guidance was the first step. The board flagged that amending tax law or introducing new taxing regimes will lead to more complexity. The board identifies areas where further guidance is needed. These include, for example:

- decentralised finance (DeFi) (Recommendation 9.5);

- chain splits/hard forks (Recommendation 9.6);

- GST for stablecoins (Recommendation 10.1);

- GST for NFTs (Recommendation 10.3); and,

- GST-free supply designations (Recommendation 10.4).

In some instances, the board makes specific reference to publications, such as GSTR 2002/2 in relation to GST for stablecoins (Recommendation 10.1).

As such, the preferred approach is to improve guidance first, and then ensure that such issues are reviewed (Recommendation 9.5). The board’s approach is to have amendments to the tax laws be a last resort.

Data capture and intermediaries are relevant to the solutions

Importantly, the government and ATO are not the only stakeholders that are in the line of sight by the board.

The board in particular makes it clear the importance of getting the calculations right and the challenges in data capture from various sources, including crypto exchanges (Recommendation 11.1).

Moreover, the role of software tools – “crypto tax software” – come under the spotlight (Recommendation 11.2). In its deliberations, the board did not see it as the role of the ATO to “review, critique or endorse” any particular software product. It is the taxpayer’s responsibility to get it right, however there are clear challenges and guidance is needed regarding the useability, coverage and outputs of such software (Recommendation 11.2).

Data capture is inherently front of mind. The board looks to issues such as the source and quality of data matching (Recommendation 11.3) and the level of activities disclosed on a prefill report (Recommendation 11.4).

The Government’s response

In response, the Government has at this stage provided limited details to specific recommendations. This is in part due to many of the recommendations being relevant to the ATO.

Importantly, the ATO has confirmed it will form a crypto working group to consult with industry and tax professionals to build a “package of publicly available crypto tax advice”.

Otherwise, the Government agrees in principle with using the board’s principles framework as a broad guide in assessing suitability for potential amendments to the tax laws pertaining to digital assets and transactions.

It is important to note that the Board of Taxation in their report did not recommend any immediate change in law, to which the Government agreed.

The board also noted and the Government agreed that four areas that may benefit from further consultation include Decentralised Autonomous Organisations (DAOs), Decentralized Finance (DeFi), Gaming Finance (GameFi) and Non-Fungible Tokens (NFTs) (Recommendation 13.2).

Where to from here?

In contrast with the final report released in 2021 by the Australia as a Technology and Financial Centre Committee, the Board of Taxation presented a clear message less focused on amending the tax laws and more on the administration and guidance. This is notwithstanding a clear message that further consultation is necessary. The report provides details of numerous policy issues for the Government to consider, extending to issues such as super, charities and donations.

With the ATO having indicated that a working group will be formed and a willingness for a pack of advice to be developed, perhaps no matter the outcome of the upcoming election, there will be more certainty in the future for the tax implications of the crypto economy.

Disclaimer: Elizabeth Morton was part of the working group for the Board’s review. The views and opinions presented in this blog are solely those of the author and are based on the author’s interpretation of the published report.

Recent Comments