In the first part of this series, we followed the introduction and abolition of the first ‘Basic Income’ scheme, the Speenhamland system in the United Kingdom in the 19th century. When Britain industrialised, cash benefits were replaced by the ‘New Poor Law’ and the Dickensian workhouse. The conclusion drawn by social reformers was that to end poverty and financial insecurity, they would have to work on a broad front: from industrial regulation to universal suffrage and the construction of a welfare state (social security, education and community services).

The Australian post-war welfare state was built upon a ‘social minimum’ in two parts.

In the labour market, it included a high minimum hourly wage, full employment and regular working hours (for men), and a high unionisation rate that supported collective bargaining and industrial arbitration. Frank Castles (1996) described this as a ‘wage-earners’ welfare state’.

This was complemented by social protections won through universal suffrage and political campaigning. They included free public education, (mostly) free public health services, a robust public Vocational Education Training (VET) system, the Age Pension, an unemployment benefit safety net backed by a public employment service, and family payments to supplement the minimum wage and reduce child poverty (both for families in & out of paid work).

It’s now argued that these social protections (at least for people of working age) cannot be sustained as the neo-liberal form of capitalism has removed trade barriers, restricted public spending, and brought intense competitive pressure to bear on the labour market so that a regular job as we know it will soon be a thing of the past. This is one of the main arguments for a new system of social protection to replace the social security system and/or minimum wages: a Universal Basic Income (UBI). More ambitious than Speenhamland, this form of basic income would extend well beyond the working class as a universal citizen entitlement.

Some UBI advocates argue that the final nail in the coffin of traditional ‘welfare’ is the emergence of the ‘gig economy’ and widespread use of intelligent machines, which have been predicted to displace almost half of today’s jobs. This, they argue, would make room for an economy where we don’t need to work as long or hard as we do now. With fewer jobs, the link between social security and paid employment will become outdated and ‘work tests’ will be pointless.

In our search for the ‘shock of the new’, we sometimes forget that Australia has undergone three decades of labour market and social change, including expansion of the role of markets in a traditional domain of the State (for example VET and employment services), the re-casting of women’s roles in care and the formal labour market, the erosion of collective bargaining and the shrinking of industrial awards to a safety net, and growth in part-time and casual employment.

What’s changed and what has stayed the same?

Some of the above predictions are wide of the mark. It’s vital that we understand to what extent the old rules of the economy and welfare state have changed, and to what extent they remain the same.

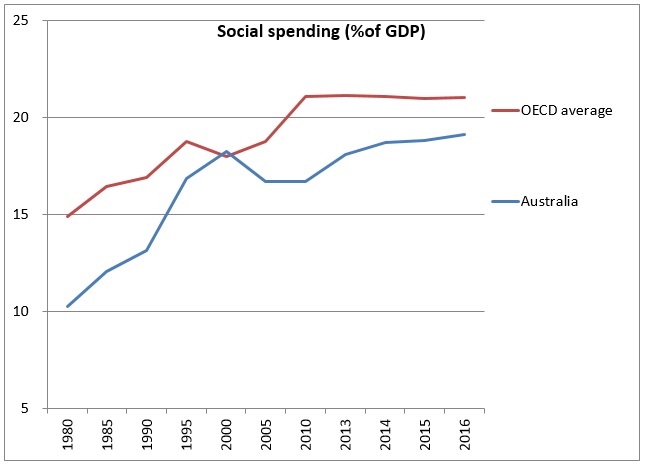

First, and most obviously, public social expenditure has not collapsed despite decades of ‘austerity’ policies (see Figure 1). As quickly as old programs were cut, new needs were identified (especially in health care).

Figure 1: Public social expenditure has grown

Source: OECD Social expenditure data base

Rather than retrench social programs, governments have redesigned them and shifted priorities. Among the most important changes were ‘activation policies’, which prioritise employment for people of working age on social security payments, and the use of market mechanisms for government services.

One of the biggest shift in priorities in Australia and elsewhere was from benefits and services for people of working age (which have been neglected while their recipients are pilloried in the media), towards necessary improvements in retirement incomes and health care as the baby boomers retire (Daley & Coates 2016).

One sign of this bias against poorer, younger people is the failure in Australia to increase Youth and Newstart Allowances for unemployed people and students, whose real value has been frozen for the last 20 years. As a result, Newstart Allowance for a single adult is just $270 a week, $180 less than the pension. Pensions are indexed the way all social security payments should be: to wage movements, so that those on the lowest incomes share in the benefits of productivity improvements across the economy.

Another sign is the ‘welfare dependency’ mantra which blames unemployed people, sotto voce, for the cost of social security, even though unemployment payments comprise just 10% of overall Commonwealth social security and welfare spending (ACOSS 2017).

Activation policies

Over the past 25 years, expectations of paid workforce participation among social security recipients have intensified, under ‘activation’ policies pursed in most wealthy nations. This is part of an international trend towards higher workforce participation in wealthy nations, especially among women.

Activity requirements aren’t new for people we used to classify as ‘unemployed’: work tests have always been part of the eligibility conditions for unemployment benefits. What’s changed is the scope and intensity of these requirements (including supervised job search and joining training courses and other programs), and their extension to ‘new groups’ of working-age payment recipients. In 2003, the Howard Government launched an ‘Active Participation Model’ of employment services in which unemployed people had to follow a ‘service continuum’ of gradually intensifying requirements including Work for the Dole. Three years later these requirements were extended to many sole parents and people with disabilities under the ‘Welfare to Work’ policy.

Promotion of workforce participation, and help to secure a decent job, has potential benefits. Whiteford & Adema compared anti-child poverty policies across wealthy nations and found that a combination of adequate benefits and help to secure paid employment – as pursued in the Nordic countries – achieved the best results. Where many are excluded from paid work by structural changes in the economy, disabilities, or caring roles, public investment in paid work experience, training, child care and other employment-related assistance (including partnerships with employers to encourage them to take on people they would not otherwise employ) can make a difference.

Employment assistance is in need of improvement in Australia, where over two-thirds of people receiving Newstart Allowance have received income support for more than a year, often for the above reasons.

Not all countries have pursued the same ‘activation’ policies. It’s widely acknowledged that some countries aim to strengthen people’s work capacities and skills while others resort to ‘work first’ policies that impose activity requirements mainly to pressure people to leave benefits as quickly as possible. ‘Work for the Dole’ is a good example of the latter approach.

In Australia today, unemployed people are caught in a welfare trap but not the ‘intergenerational dependency’ the present government claims. They are caught between the high expectations and ever-increasing requirements of activation policies and the reluctance of governments and employers to invest in people who can’t simply walk into a job within a month or two of unemployment, even if the labour market picks up.

Our lean welfare state imposes maximum activation with minimum support. For example, unemployed people must generally search for 10 jobs a fortnight but consultant caseloads in ‘jobactive’ services of up to 300 have been reported. Many don’t receive the help they need.

As long as our two-tier social security system remains, ‘welfare to work’ policies mean that a growing number of parents and people with disabilities are shifted from pensions to the lower Newstart payment.

In recent years, the government has imposed new expectations on unemployed people that extend well beyond what can reasonably be expected to improve their job prospects: 15 to 25 hours a week of ‘Work for the Dole’, income management, and lately drug tests – all on the assumption that unemployment is caused by some kind of moral failure.

It seems the poor law is still with us.

Yet, activation policies challenge at least part of the old poor-law logic: if all who are able to join the paid workforce are required and supported to do so, there is no longer any justification to pay them less than those who cannot. Activation policies make the pension-allowance divide redundant, opening up the possibility of a ‘basic income’ that’s based on need rather than ‘deservingness’.

What’s changed in the Labour market?

Economists have been predicting the emergence of a ‘leisure society’ for a long time now. John Maynard Keynes famously predicted that by 2030 most jobs would be part-time and that ‘we shall do more things for ourselves than is usual with the rich today, only too glad to have small duties and tasks and routines.’ As John Quiggin points out, Keynes missed a few important trends including the conversion of much of traditional ‘women’s work’ into paid jobs. And of course, capitalism and modern marketing created new ‘needs’ which kept our noses to the (paid work) grindstone.

This is not the place to follow these debates in detail. The following relies much on an excellent paper by Borland & Coelli (2017), in which they track the impact of technological change on the Australian labour market over the last two decades, and assess whether jobs have become more scarce or precarious. Below are some of their key conclusions.

1. Jobs and working hours have not declined overall

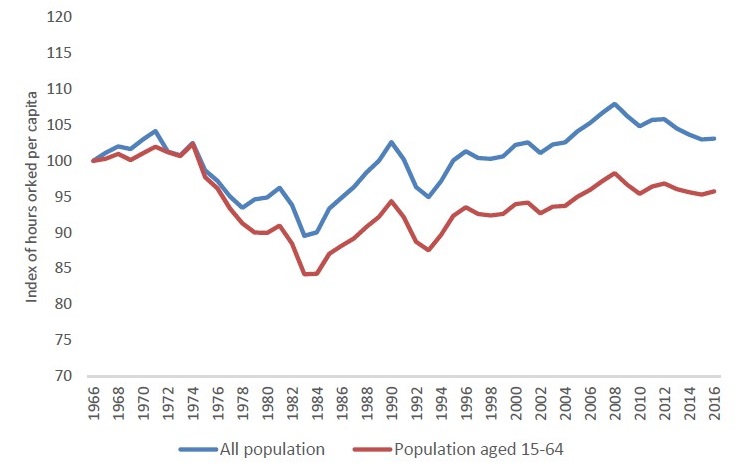

Since much growth in employment has been part-time, the volume of working hours per capita is a better summary of the state of employment than the share of people employed.

Figure 2 shows that, apart from the 70s and early 80s (which economist Bob Gregory called the ‘disappointing decades’), overall working hours increased from the 1960s to the Global Financial Crisis in 2008.

Figure 2: Hours of work per capita, Australia, 1965/66 to 2015/16, Actual hours worked series (Equals 100 in 1965/66)

Source: Borland J & Coelli M (2017)

2. Robots won’t simply replace jobs, they will redistribute and redesign them

In 2013, Frey & Osborne made the explosive prediction that over the next decade or two from 2010, 47% of US jobs were at high risk from the spread of intelligent machines (computers and robots).

Others argued that this risk was unlikely to be realised in most cases, as intelligent machines complement the work of humans as well as displacing it. Borland & Coelli (2017) suggest that 10% or less of current jobs in Australia will go over the next few decades.

Whether we end up with the same number of jobs and hours per capita or not, there is a broad consensus that the labour market will continue to polarise between skilled and routine jobs, and manual labour and services (with the former gaining ground at the expense of the latter in each case):

Computerization has substituted for low-skill workers in performing routine tasks while complementing the abstract, creative, problem-solving, and coordination tasks performed by highly-educated workers.

As the declining price of computer technology has driven down the wages paid to routine tasks, low-skill workers have reallocated their labor supply to service occupations, which are difficult to automate. (Autor D & Dorn D (2013))

Figure 3: Share of employment by skill (Australia, 1986-2006)

Source: Borland & Coelli (2017)

So far, the losers have been workers with skills suited to routine jobs, especially routine manual jobs.

3. Jobs are less secure for some, much the same for others

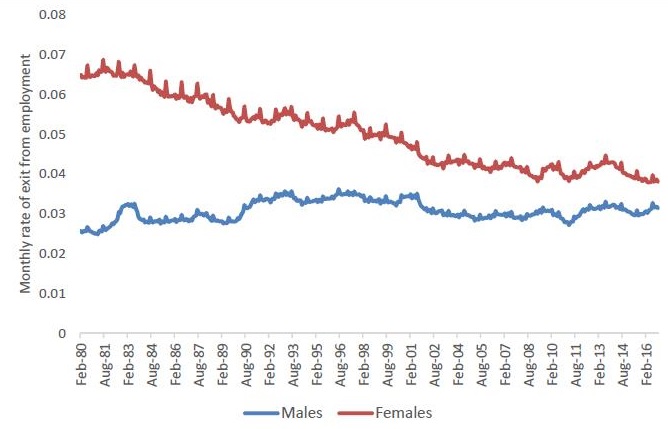

Another common claim is that jobs are less secure and more people are unable to obtain the working hours they need for a decent income. The real story here is mixed – with winners and losers depending on age and gender.

Figure 4 shows that a declining share of employees is leaving or losing their job each year, and that job turnover among women is converging downwards towards male turnover rates (which are gradually rising). Men still fare ‘better’ (to the extent that staying in the same job is a good outcome, which is not always so), but less so than in the past.

Figure 4: Rate of outflow from employment: Australia (1980-2016)

Source: Borland & Coelli (2017)

Figure 5 shows trends in un- and under-employment. That is the share of people who lack the paid hours they seek.

The striking trend since the early 1990s is the divergent experiences of young, middle-aged and older people. It is clear that young people have borne the brunt of growth in un- and under-employment since then. However, if mature age workers lose their old ‘steady job’, they seem to face a labour market just as hostile as that confronting young people.

Figure 5: Labour under-utilisation (unemployment + under-employment) by age (Australia, 1978-2014)

Source: Borland & Coelli (2017)

4. The ‘gig economy’ is not new

Growth in precarious employment is not inevitable. Jim Sandford points out that for the first half of the 20th century a large share of jobs, especially low-skilled ones – were either casual (daily hire) or paid at ‘piece rates’ (according by work done rather than by the hour).

In the 1940s, wharfies lined up outside the docks each day to be told whether or not they would be given a job. ‘Uberisation’ is a high-tech version of the ‘hungry mile’.

‘It was to this mile of wharves that maritime labourers in the nineteenth century and on into the 1940s, tramped each day regardless of the weather to find casual, low paid work, because that was the nature of waterfront work in those days.’ (Source: Rowan Cahill, Union Songs)

(Source: New York Times)

We managed to turn the tide against casualisation under conditions of full employment after World War Two. Information technology increases the risk, but also makes it easier to organise against it (for example, through union recruitment campaigns, cooperatives, and consumer boycotts).

There is a danger that if we concede defeat in the face of the ‘gig economy’, casualisation could become a self-fulfilling prophecy for a new generation of workers.

Conclusion

The threat to traditional forms of social protection is real, but it does not take the form that is popularly assumed. Jobs are not disappearing but workers with ‘routine skills’, and people entering or re-entering paid work after a long absence (including many young people, women and retrenched mature-aged workers) face greater risks of unemployment and job insecurity.

The welfare state is not shrinking but it is increasingly subjected to market disciplines, for example in the treatment of unemployed people.

In Part 3 and Part 4 in this series, we ask whether a UBI or other variant of a basic income could help mitigate these risks.

This four part series is written based on the presentation, ‘From basic income to poor law and back again: can a UBI break the Gordian Knot between social security and waged labour?’, by Peter Davidson at the Australian Social Policy Conference at UNSW on 27 September 2017. Read Part 1, Part 3 and Part 4.

Pingback: From Basic Income to Poor Law and Back Again: Part 1 - Austaxpolicy: The Tax and Transfer Policy Blog

Its a good point about the Ubers ye have always had with ye. One thing you have to bear in mind in looking at long run time series of the Australian labour market is that right up until the 1980s Australia had a large and marginalised seasonal agricultural workforce that was effectively excluded from official measurement of incomes and work (this, for example, is why the ultra-low unemployment rates of the 1950s and 60s were probably not actually quite so low). Maybe the farmers should have pushed for more Speenhamland, or maybe even the ancient Egyptian system of outdoor relief for seasonal workers (the pyramids were a gigantic Work For The Dole scheme).

Also many more women were actually working in the Uberised sector of the economy than our ‘male breadwinner’ mental model of those times would indicate.

Pingback: From Basic Income to Poor Law and Back Again - Part 3: Renewing the Social Minimum - Austaxpolicy: The Tax and Transfer Policy Blog

Pingback: From Basic Income to Poor Law and Back Again - Part 4: Designing a Viable Basic Income - Austaxpolicy: The Tax and Transfer Policy Blog