In a recent article for the Tax Institute, published in the Australian Tax Forum, we explore the acceptance of the Australian e-filling system, myTax, using an extended Technology Acceptance Model that is commonly used in information system studies. We seek to predict the intention of Australian taxpayers to adopt and use myTax in the future.

In line with the increased adoption of myTax, it is important for policymakers as well as authorities such as the Australian Taxation Office (ATO) to have a better understanding of taxpayers’ propensity to adopt and keep using the system in the future. We argue that the ATO must keep enhancing the system to maintain and attract new users.

E-lodgement in Australia

The ATO joined the Australian Government myGov platform in 2013 by launching a renewed online e-lodgement system known as myTax for Australian taxpayers to meet their tax obligations. myTax system was operational from the 2013-14 tax year and replaced the former e-Tax system in 2015-16.

According to the ATO, the transition to myTax created a range of benefits for taxpayers, including its ‘24/7’ availability; a faster process of refund with a 14 day turnover, its availability to an expanded scope of taxpayers (including individual taxpayers, sole traders and contractors), the availability of pre-filled information, and improved cyber security to protect taxpayers’ data.

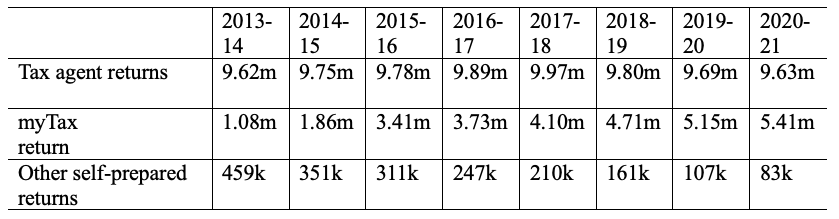

While the uptake of myTax is on the rise, tax agents remain the preferred means of tax lodgement for Australian taxpayers to meet their tax obligations (see Table 1). However, the number of tax returns prepared by taxpayers using myTax has increased by 400% since the 2013-14 tax year compared with a zero increase in those using tax agents. Paper-based tax returns – by comparison of frequency – are almost obsolete; however, may reflect the continuing digital divide in society.

With the adoption of e-filing in Australia alongside other technological advancements to the tax system, scholars have called for future research to reconsider drivers of tax compliance behaviour as such drivers are likely to change over time.

Table 1: Tax lodgement method

Source: compiled from ATO.

Source: compiled from ATO.

Technology acceptance of myTax

Collecting online survey responses from 193 Australian taxpayers who have used myTax to meet their tax obligations, we employed the extended Technology Acceptance Model to gain insight into the propensity of Australian taxpayers to use and adopt myTax. The model predicts users’ acceptance of the information technology by accounting for the correlations between its variables being (1) perceived usefulness, (2) perceived ease of use, (3) attitude toward using and (4) behavioural intention. To further enhance the model, three external variables – information quality, system quality and perceived credibility – were added.

Our analysis indicates that Australian taxpayers were mainly influenced by the information quality and the perceived ease of use of the myTax system.

myTax users perceive the information provided (such as pre-filling data) as easy to understand, accurate, relevant, and adequate for reporting their tax information. In turn, this has influenced their perceived ease of use, their attitude toward using the system and subsequently their behavioural intention to use the system again in the future.

Australian taxpayers are also perceiving the process of meeting their tax obligations via myTax to be clear, understandable, and easy. This indicates that myTax is meeting the needs of taxpayers and that their continued use and adoption of myTax is highly likely.

Comparison with other jurisdictions

Whilst we do not directly examine other jurisdictions, we note diversity in the intention to adopt e-filing technology. For example, for Taiwanese taxpayers, their behavioural intention is mainly influenced by the perceived credibility and the system quality of the tax lodgement system.

In the Philippines, America and Indonesia, taxpayers’ behavioural intention to adopt the e-filing was found to be mainly influenced by trust factors (such as trust in the government).

In Malaysia, taxpayers were found to be influenced by their perceived ease of use, perceived usefulness, trust, image compatibility and other factors, whilst Indian taxpayers are influenced by the perceived ease of use, the performance of the system and other factors.

These differences may be explained by not only the differences in tax culture, but also accessibility factors, the technological infrastructure and more generally whether they are a developed or developing country.

Implications

While this study has contributed to understanding the factors influencing Australian taxpayers’ intention to use and adopt myTax in the future, policymakers must keep enhancing the system to maintain and attract new users.

With funding provided to “sustain myGov” in the 2023-24 Federal Budget, we argue that there needs to be a focus on ways to improve the platform and posit that a key area of focus is the information quality myTax delivers. A system with high information quality generates and delivers information that is relevant and accurate to users. We argue that this will help maintain current users and even attract new taxpayers as this is the most significant predictor of users’ behavioural intention.

Recent Comments