Now, more than ever, tax reform can play a role to support a sustainable, resilient future. The tax system is a powerful driver of Australia’s economy. Taxes and subsidies change the price of a good or service for producers, consumers and investors. We carried out an environmentally focused evaluation of Australia’s tax system across three main areas: pollution, energy, and land use and restoration.

Tax reform to address climate change

Carbon emissions per capita in Australia are among the highest in industrialised economies. Some estimates place consumer emissions at more than three times our share of the world population.

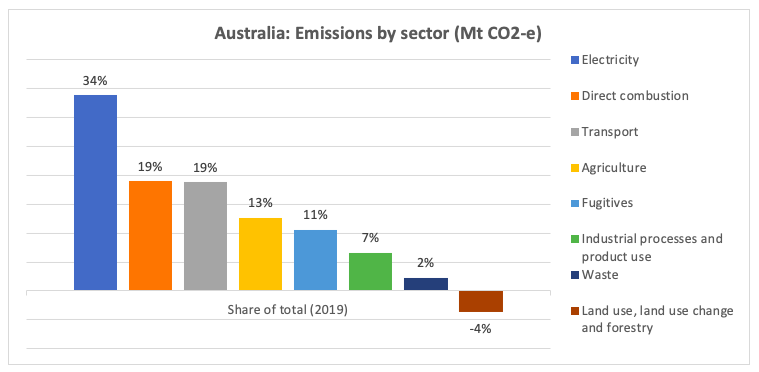

Own construction. Source: Department of the Environment and Energy 2019, Australia’s Emissions Projections 2019.

More than 75 per cent of Australia’s electricity generation comes from fossil fuels. We under-tax the production and use of polluting or non-renewable energy sources such as coal, oil and gas. A key policy option is to reintroduce a carbon price or emissions trading system. There may be concerns about raising prices of polluting energy during the economic recession induced by COVID-19, but as noted by the Economist recently, countries should seize the moment. Even a small carbon price could make a difference and it must be considered as part of a tax reform package for Australia that could enable lowering other tax rates.

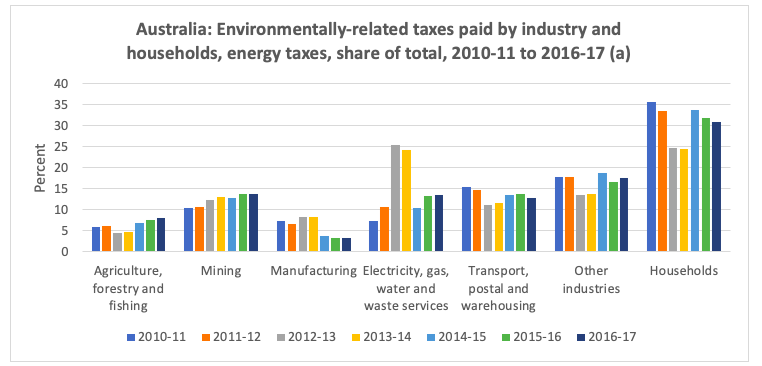

Own construction. Source: Australian Bureau of Statistics, Australian Environmental-Economic Accounts 2019. (a) Includes Excise on Crude oil and LPG, Carbon pricing mechanism, Renewable energy certificates, Energy Savings Scheme, Greenhouse Gas Reduction Scheme, The Queensland Gas Scheme, The Retailer Energy Efficiency Scheme and Victorian Energy Efficiency Target scheme.

Supporting energy efficiency

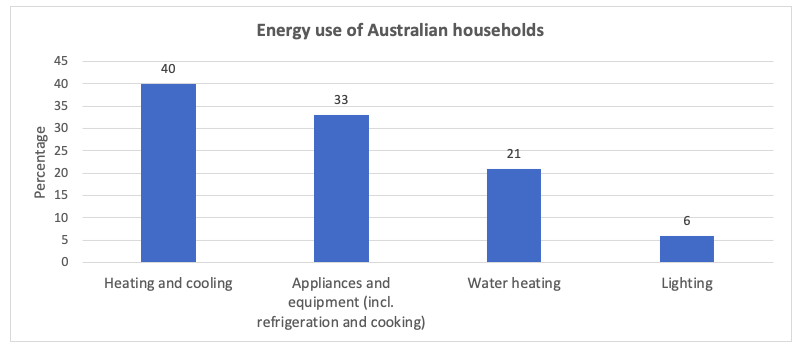

Tax reforms to support investment and consumption in energy efficient equipment could positively influence the energy use of Australian households. Homeowners and renters cannot deduct the cost of upgrading their home heating and hot water systems or appliances to a renewable or energy-efficient source.

Own construction. Source: Australian Government, Your Home: Australia’s guide to environmentally sustainable homes.

For landlords, the cost of installing such systems is depreciable for income tax, but this may be less attractive than an immediate deduction for repairing old, inefficient or non-renewable systems.

Tax reforms, including any extension of the government’s COVID-19 business stimulus package, could target tax deductions, credits or concessions towards energy efficient domestic consumption or investment, as well as supporting energy efficiency and the use of renewables by businesses.

Encouraging sustainable transport

Current tax policy influences the choice of polluting transport options for Australian businesses and consumers, through schemes like fuel tax credits, fringe benefits tax rules for cars and carparking, and accelerated depreciation for polluting heavy vehicles or equipment.

The tax system could be refocused to support the uptake of energy-efficient vehicles, investment in bicycle infrastructure and by introducing a general vehicle road user charge. Public transport commuting could receive a tax credit, as is done in some countries and a proxy for road use, such as London’s congestion charge, could be adopted in our central cities.

The policy decision is more complicated for electric vehicles. Because Australia’s electricity generation is so heavily dependent on fossil fuels, a fast shift to electric vehicles may not reduce emissions in the short term. Some consider that electric vehicles in Australia are already subsidised, as they do not pay fuel tax (which proxies a road user charge); one road and infrastructure industry thinktank has called for a uniform road user charge including electric vehicles. The luxury car tax is also lower for electric or hybrid vehicles and registration discounts exist in some States.

However, electric vehicles remain expensive with a tiny market share (0.2 per cent of purchases in 2017). As renewables start to dominate electricity generation, we need to shift business and consumer vehicle usage away from oil and gas. It is likely that this requires further tax incentives to shift consumer behaviour. An example is Norway, with comprehensive tax incentives for electric or hydrogen vehicles (which are zero emission because of renewable electricity generation in that country). Battery electric and plug-in hybrid vehicles in Norway now have 50 per cent of the market and it aims for all new car sales to be electric or hydrogen by 2025.

Land conservation and clean-up

Tax reform could also support land conservation and clean up. The income tax permits deduction of business costs for environmental rehabilitation, clean-up and pollution prevention but there is no write-off for land that is not used to generate income.

An opportunity exists to reform State land taxes. As well as transitioning from stamp duty to land tax, reforms need to address land tax valuation methods, rates and base as part of a coherent national policy framework. Here, environmentally sound policy is consistent with good tax policy, aimed at broadening the base for taxation. A land tax exemption applies for land used to generate income from primary production, but land restored or preserved as bushland is taxable. A level playing field could be produced by removing the primary producer exemption, or extending the exemption reforested bushland.

Clearing of forests is the most influential source of emissions deriving from land use in Australia. It is also a missed opportunity: in 2019, the sector offset 4 per cent of emissions from other sectors, through carbon sinks from regrowing forests. To encourage more land into conservation and nature restoration programs, we should review the effectiveness of the tax-deductible land conservation covenant program.

GST reform for sustainability

Revenue and sustainability considerations require us to explore potential reforms to the Goods and Services Tax (GST). Most agricultural emissions come from beef and dairy cattle farming, and rethinking Australia’s livestock systems is crucial for risk reduction. The GST has many exemptions some of which, including those for basic food, assist in delivering equity. While removing GST exemptions is unpopular, it is important to note that exemptions for water services, meat, dairy, sugar and bottled water are inconsistent with policy to support good health and to reduce emissions and land degradation. It is estimated that significant revenue could be raised by careful base broadening. A reform to remove environmentally damaging exemptions, applying a neutral tax, should be carefully designed, with compensation to address distributional concerns.

A key moment for action

The full effects of the COVID-19 pandemic on people, the planet and the economy are not yet known, but the big challenge of responding to climate change and ensuring an environmentally sustainable future remains. The devastating 2019-2020 bushfires evidenced the possible future impacts of inaction.

We should aim to ‘build back better’ our economic systems including taxation. The best strategy may be to change tax settings that incentivise polluting or energy-inefficient options for producers, while demand side reforms for consumers are also important and may have lower efficiency costs. Without reform, Australia’s tax system will continue to distort behaviours towards pollution and the externalisation of costs to be borne ultimately by society and our environment.

A more detailed analysis of Australia’s tax system effects for pollution, energy and land use, and options for reform, are in three policy briefs published by the ANU’s Tax and Transfer Policy Institute: Tax and Pollution (Policy Brief 1/2020), Tax and Energy (Policy Brief 2/2020) and Tax, Land Use and Nature Restoration (Policy Brief 3/2020).

If taxes are being used to enable polluters to continue to pollute than how can this benefit our environment when it’s critical NOW to stop pollution from burning of fossil fuels. We should be encouraging a transistion immediately to renewables.

A better approach would be to introduce legislation that prohibits certain types of pollution rather than allowing it to continue. Taxes should only be used to redistribute wealth/ resources, discourage other types of public negative externalities and control inflation.