Much of the current debate in international tax policy focuses on multinational corporate groups who use “aggressive” tax planning to minimize the group tax burden. However, on the other end of the spectrum we find multinationals who consistently report a comparatively high tax burden. Several reasons may apply: tax laws for specific business activities or countries are not in their favor, tax is not managed actively, or tax is not managed well. Standard economic theory, which would predict economically optimal decision making, including tax minimization (after accounting for all related costs such as planning, litigation or reputation), does not explain variation in effective group tax rates.

One potential explanation of variation in tax outcomes for multinational firms is the personality of the individual who takes tax decisions in the firm. While corporate tax decisions in the firm are often outsourced and subject to professional scrutiny and debate, prior research (Dyreng, Hanlon and Maydew 2010) has shown that personal characteristics of executives matter to a firm´s tax behavior.

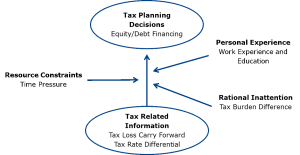

We test in an experimental setting whether the use of heuristics in decision making may have an effect on tax planning decisions, in particular, decisions made under time pressure. Heuristics are simplifying decision strategies predominantly applied in complex situations. Prior research has already given some insight that decision makers rely on tax rate rather than tax base information, in making tax planning decisions. Yet until now it has been unclear whether this is also true for a tax planning decision on the basis of an obvious economic rationale where subjects deliberately intend to minimize tax. In our study we find robust evidence that decision biases offer a behavioral explanation for suboptimal tax planning decision. The use of an experimental method allows us to isolate causal effects in a controlled environment.

The tax planning scenario

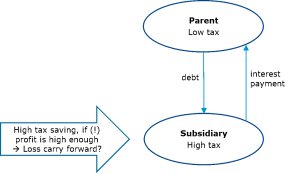

We design a simple tax planning scenario within a multinational corporate group. Specifically, we set up an intra-group, cross-border financing decision for the corporate group executive. We vary the statutory tax rates of the parent (located in a Low tax country) and and the foreign subsidiary (located in a High tax country). We also vary the tax base of the subsidiary by altering the deductible loss carryforward available to the subsidiary. Depending on the size of tax rate differential on the one hand, and on the size of the loss carryforward on the other hand, either debt or equity financing minimizes the multinational group’s total tax burden.

We design a simple tax planning scenario within a multinational corporate group. Specifically, we set up an intra-group, cross-border financing decision for the corporate group executive. We vary the statutory tax rates of the parent (located in a Low tax country) and and the foreign subsidiary (located in a High tax country). We also vary the tax base of the subsidiary by altering the deductible loss carryforward available to the subsidiary. Depending on the size of tax rate differential on the one hand, and on the size of the loss carryforward on the other hand, either debt or equity financing minimizes the multinational group’s total tax burden.

For example, where the tax rate in the subsidiary’s country is much higher than in the parent’s country, and where the subsidiaries’ loss carryforward is very small, debt financing is optimal, because the subsidiary can deduct the interest expense and the tax saving from interest deductions is substantial. On the other hand, where the tax rate differential between the two countries is small, and the subsidiary´s profit is consumed by a large loss carryforward, debt financing does not yield any tax savings. Instead equity financing is optimal.

Experimental design

The experiment took place in a computer lab at WU Vienna University of Economics and Business. Our sample comprises 141 experienced students from WU Vienna University of Economics and Business who have a solid background in business administration, business law, and/or economics. Approximately half of our participants have work experience in the field. Even though business students are not (yet) CFOs, prior research emphasizes the generalizability of experimental testing of educated students to “real life”.

We ensure that the participants are fully informed about the tax consequences of their decision, giving them every possibility to decide on an economically optimal basis. We then ask participants to indicate the tax-minimizing form of financing (i.e. equity or debt capital) in 16 different instances (i.e. different combinations of tax rate effects and tax base effects). These 16 decision items are carefully and symmetrically designed, and are presented to the participants in random order.

We specifically test the use of heuristics in decision making under time pressure. Sixty per cent of the participants have to make their decision under time pressure. This set-up implies a factorial experimental design with between-subject and within-subject variation.

Time pressure matters for optimal tax planning decisions – and tax rate is more salient

Our statistical analyses (logit regression) reveal that indeed, under time pressure, the probability of taking an optimal tax planning decision is significantly lower where the use of equity financing, rather than debt financing, would be optimal, i.e. where the loss carryforward (tax base) effect dominates the tax rate effect. This supports our hypothesis that the more salient tax rate information leads to a systematic decision bias.

Surprisingly, personal characteristics such as advanced work experience or education in accounting, finance, or tax do not lead to “better” decisions. We find that heuristics are used by experienced and educated participants as well. In contrast to participants without any work experience, those participants who had spent some time working in the field rely even more on the salient tax rate information, in contrast with their self-perception: while they indicated higher confidence in their choices than other participants, in fact they performed worse, which suggests an overconfidence bias. Decision biases in tax planning are therefore largely independent from personal characteristics.

Surprisingly, personal characteristics such as advanced work experience or education in accounting, finance, or tax do not lead to “better” decisions. We find that heuristics are used by experienced and educated participants as well. In contrast to participants without any work experience, those participants who had spent some time working in the field rely even more on the salient tax rate information, in contrast with their self-perception: while they indicated higher confidence in their choices than other participants, in fact they performed worse, which suggests an overconfidence bias. Decision biases in tax planning are therefore largely independent from personal characteristics.

We also tested for the theory of rational inattention. We would expect that in decisions where the difference between possible outcomes (the tax burden at stake) is rather large, participants “think harder” and rely less on heuristics. This hypothesis is supported: where the tax burden difference between equity and debt financing is large, the probability for an optimal decision increases significantly relative to decisions where the tax burden difference is small.

Several robustness checks support our main findings. To summarize, we find that:

- Subjects systematically base their decisions on statutory tax rates

- Time pressure aggravates the decision bias

- Personal experience in accounting, taxation, and/or finance does not mitigate decision biases

- The size of the tax burden difference between debt and equity financing mitigates the decision bias.

We therefore conclude that since tax planning decisions have a behavioral dimension, decision biases likely occur in a corporate environment. This result seems relevant for tax executives who should keep in mind that intuitive choices are not necessarily the best. It also seems relevant for drafting legislation: tax laws should provide all information in a salient way to ensure their observation.

The blog entry is based on the paper:

Harald Amberger, Eva Eberhartinger, and Matthias Kasper: “Tax Rate Biases in Tax Planning Decisions: Experimental Evidence”, WU International Taxation Research Paper Series No. 2016-01

Recent Comments