Starting from July 2018, Australia’s current ‘complex and costly’ child care subsidy system will be replaced by a new single Child Care Subsidy (CCS), after the child care package legislation was passed by the Australian Parliament in March 2017. The Government says its aim in re-designing the child care system is to help make it easier for women to return to the workforce.

In this article, we conduct an analysis of the reform’s labour supply and child care impacts on two-parent households. Specifically, we examine partnered women’s labour force participation; household child care demand; household budgets; the change in child care costs faced by families as a result of the reform; and government expenditure. Our estimates provide richer input into a discussion of the costs and benefits of the reform and an important piece for understanding the reform.

Australia’s current child care system consists of a means-tested Child Care Benefit (CCB) and a non-means-tested but capped Child Care Rebate (CCR). CCB has a complicated structure, incorporated in our model, that depends on a variety of household characteristics. Families’ CCB entitlement decreases with family income and depends upon the number of children in care and the number of paid child care hours. The hourly CCB payment rate is higher if more children are in care or if less than 38 hours of care are used.

In addition, CCB has loosely-enforced work and training requirements—in households where at least one of the parents is not working or participating in training/education, the maximum subsidized number of hours is limited to 24 (rather than 50). CCR can be claimed by families, regardless of income levels, for 50 percent of their out of pocket child care expenses up to a total maximum of $7,500 per child per year. Under the current regime, low-income families and families on income support obtain the maximum CCB, and for families on higher earnings, the payment tapers. For example, few families with income above $180,000 per annum receive child care benefit for formal child care costs, but they can still receive CCR.

Under the new system, the two subsidies will be replaced by a single means- and activity-tested subsidy, CCS. The income test of CCS is a little simpler compared to that of CCB: it will cover 85 percent of fees for families on incomes of $65,710 or less, but tapers down to 50 percent of charges for families on $170,710-$250,000, and after $250,000, tapers further down to 20 percent for families on $340,000-$350,000. Families earning more than $350,000 will receive no subsidy. Fee support caps are based upon an hourly rate ($11.55 centre-based day care, $10.70 family day care, $10.10 outside school hours care) and another $10,000 annual cap on subsidies is applied to families earning more than $185,710.

Meanwhile, a new activity test is introduced. Families will only be eligible for the subsidy when each parent undertakes an approved activity (work and some types of study or training) for at least eight hours per fortnight. The subsidised hours per fortnight per child in care are up to 36 hours if parents work for more than 16 hours per fortnight and increase to 100 hours when they work greater than 48 hours. Families who fail to meet the activity test requirements and who have incomes of approximately $65,000 or less, will qualify to receive up to 24 hours of support for each child per fortnight. Thus, although the new scheme is called ‘simplified’ by the government, it is perhaps not that simple. At least in terms of the percentage of subsidy provided for various income levels, it should be easier for families to work out how much CCS they are eligible for.

We simulate some of the effects of this policy change, using a joint, discrete structural labour supply and child care demand model which we develop and estimate in Gong and Breunig (2017). We refer interested readers to Gong and Breunig (2017) for the technical details. We address the following questions relating to two-parent households:

How will the new CCS: (i) affect women’s labour force participation? (ii) affect the amount of child care demanded by households? (iii) affect household budgets? (iv) affect government expenditure; and (v) what role does the activity test play in any changes relative to the current system? We focus on married women, who represent the largest group with care responsibilities for young children at home.

We use pooling waves five through seven of Household Income and Labour Dynamics in Australia (HILDA) data (the same as that used for estimating the model) for the simulations. We look at what would happen today if the policy were implemented. Wages and incomes are inflated by the wage price index to 2017. Gross child care prices are inflated annually from 2005 by 7 percent, which is the annual growth rate of long day care fee estimated by Department of Education and Training (2016).

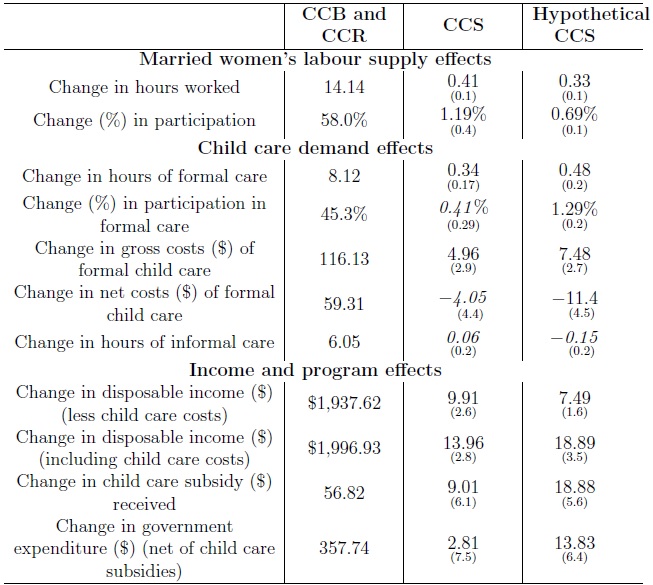

The simulated results are presented in Table 1. Column 2 contains the levels of the key variables (hours worked, percentage of women working, etc.) for the current scenario—with CCB and CCR. In Columns 3 and 4, we consider two alternative scenarios. The first one (Column 3) is the new CCS policy. The second one (Column 4) is our hypothetical CCS policy which is identical to the incoming policy, except that we apply the current (old) activity test which families face in receiving CCB/CCR. We look at four types of effects: the effect on married women’s labour supply; the effect on child care demand and expenditure; the effect on household disposable income; and the effect on government balances including child care subsidy costs and the net effect on government expenditure.

Table 1: Impact of the child care reform (Table reports average weekly changes per household)

Numbers in parentheses are standard errors.

Net government expenditure is income support, family tax benefit and child care subsidies (Child Care Benefit and Child Care Rebate) less tax revenue.

The results show that the new policy will have significant impacts on households.

First, it leads to increased labour supply for married women. Our model predicts that labour force participation will increase by 1.2 percentage points and hours worked will increase by 0.41 hours (about 24 minutes) per week. These effects are statistically significant at the five per cent level or smaller.

Second, demand for formal child care increases as the net costs faced by households decrease. Demand for formal child care hours would increase by 0.34 hours (20 minutes) per week. Formal child care usage would increase by two-fifths of one percentage point, however, this latter change is not statistically significant.

Third, average household disposable income increases by $9.9 per week. This is statistically significant. However, net government expenditure is not changed significantly. This is partly due to increased tax revenue. The increase in household disposable income is coming partly from the increased working hours of married women.

The results in Column 4 reveal that the new activity test plays an important role. For example, without the new activity test, the labour supply effect would be smaller. In particular, labour force participation would still increase, but only by 0.7 percentage point.

On the other hand, demand for formal child care would increase more than with the new activity test. For example, formal child care usage would increase by 1.3 percentage points (more than three times that of the actual new policy). At the same time, without the new activity test, government expenditure would also increase significantly, by about $13.8 per week per household.

We also compared these effects by two population sub-groups—women above and below median wages. We find the effects of the reform are generally larger for higher wage women than their low wage counterparts. The main reason is that for many higher wage women, the removal of the $7,500 CCR cap means an increase in the amount of subsidy that they will receive from the government. Due to the word limit of a blog, we do not present the detailed results, but summarise some key findings as follows.

The labour supply effect of CCS on higher wage women is a bit larger than that on lower wage women. Hours of work per week of higher wage women would be increased by about half an hour compared to about 18 minutes for the lower wage women. Higher wage women’s labour force participation would be increased by 1.35 percentage points compared to about one percentage point for the lower wage women.

Differences in the effect on child care demand are much larger between the two groups. For example, demand for child care hours from the higher wage women would be increased by about 45 minutes compared to about 13 minutes from the lower wage women.

At the same time, the gain in household income of the higher wage women ($14 per week) is much larger than the lower wage women ($5 per week).

To conclude, we find that the increase in child care subsidies associated with the implementation of the new Child Care Subsidy (CCS) is likely to have significantly positive effects on the labour supply of married women. Assuming that nothing else changes, we find that average hours worked for partnered women will increase by about 24 minutes per week while participation in work will increase by 1.2 percentage points. Child care demand will increase by similar magnitudes while out-of-pocket child care costs for families will be decreased slightly (statistically insignificant) after accounting for increased government subsidies to child care. Overall, household disposable income will increase by $9.9 per week which comprises both increased child care subsidies and increased income from working. Net government expenditure, taking into account increased tax revenues, increased child care subsidies and changes to income support and family tax benefit payments caused by changed working hours, will increase by $2.8 per household per week. However, this estimate is not statistically significant.

We find that just under half of the labour supply effect comes from the new activity test, which restricts the subsidised child care hours of women who do not participate in the labour market (or approved study or training). This activity test appears to prevent a potentially large increase in child care demand and in government expenditure.

Our results are subject to several important caveats, which include 1) our analysis is partial equilibrium; 2) we assume the macro-economic environment remains the same; 3) we are unable to quantify the effects of improved child care quality on child care demand; and 4) we ignore further repercussions from the supply side of the child care market which may also determine price changes; and that the analysis focus on partnered women only.

Further reading

Gong, X & Breunig, R 2017, ‘Childcare assistance: are subsidies or tax credits better’, Fiscal Studies, vol. 38, no. 1, pp. 7-48.

Recent Comments