In 2016 we are seeing a continuation of low oil prices worldwide, which is negatively affecting the petroleum industry, but good news for other industry and consumers. According to the Australian Government’s Mid-Year Economic and Fiscal Outlook 2015-16, the low oil price situation has already negatively impacted its revenue collections, with a 31% reduction expected from Australia’s Petroleum Resource Rent Tax. Australia’s production licence-holders of natural gas from Western Australia and the Northern Territory, and coal-seam gas from Queensland, have export gas contracts in place with formulae linked to oil prices. These producers are thus affected by the low oil price phenomenon.

The oversupply of petroleum is partly the result of lower-cost OPEC producers’ strategy to re-establish their dominance over their higher-cost North American shale oil competitors, whose success was pointing to a first ever self-sufficiency in oil. The oversupply situation has been compounded by other oil states such as Nigeria, Iraq and Venezuela ramping production for much-needed cash to shore up their oil-dependent and weakening economies.

Oil and Gas Industry Research

The author from Monash Business School, is conducting research into the impact of the slide in world oil prices on oil and gas companies, which operate, contract and service petroleum projects in Australia. On the flipside, the research is also investigating the Australian Treasury’s response in its forecasts of revenue from the Petroleum Resource Rent Tax, another falling domino in the natural resource revenue stack. A comparison is being made to the Malaysian oil and gas industry, and revenue streams to the oil-dependent the Malaysian government. The tight link between oil prices and gas prices in long-term contracts is hurting. The author has teamed up with Professor Jeyapalan Kasipillai from the Monash University (Malaysia), for the Malaysia part of the research.

The research aims to find patterns in petroleum industry reaction in Australia and Malaysia to the low oil price phenomenon. The plan includes uncovering the extent to which Australian and Malaysian governments’ revenues, treasury forecasts and policy are reacting to the drop in oil prices.

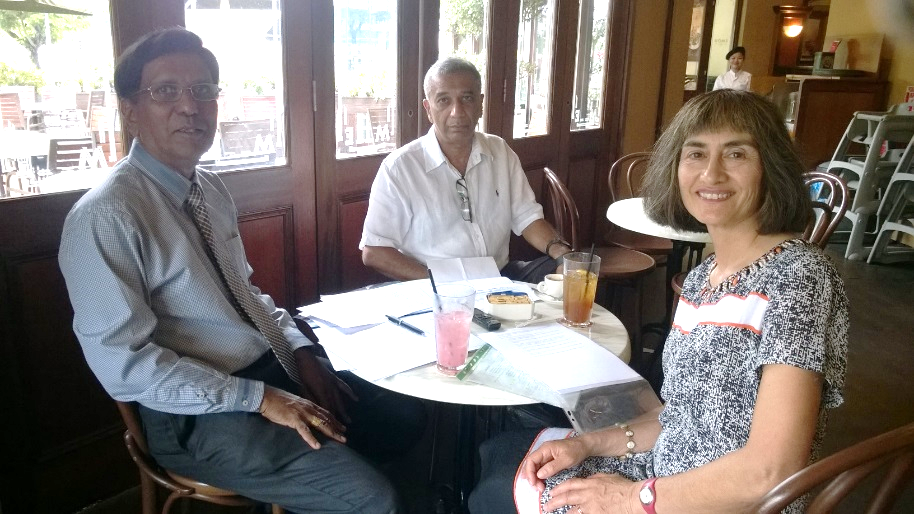

The research uses interviews as one mode of gathering primary data. In February 2016 the author and Professor Kasipillai interviewed persons in Malaysia from the national petroleum company, major and second-tier oil and gas companies that act as project operators; and industry contractors.

Petroleum Industry Contractor

Edgar Pushparatnam, was interviewed in Malaysia about the role of industry contractors in Malaysia for hydrocarbon field development, oil refining, gas processing and petrochemicals. He is a recently retired senior executive with Technip, a French global engineering contractor to the energy industry. Pushparatnam has worked mostly in the Asia-Pacific region and stated that the upstream petroleum industry is ‘the worst he has seen for 30 years,’ with contracting companies subject to deferred projects, bidding at lower prices and looking for cost savings through initiatives such as sharing of costs with other contractors. His view that the industry in 2016 is in survival mode aligns with that of oil and gas industry analysts, Wood McKenzie. Oil industry participants are facing a struggle through the downturn and hope to survive without too much permanent damage.

Pushparatnam is critical of the Australian government’s lack of control of the mega natural gas projects off Western Australia as ‘too many oil majors are vying against each other’ and driving up costs. By contrast, Petronas, Malaysia’s national oil company, he says, has the regulatory power to organise the extraction of its finite resources in a more orderly manner.

Upstream oil majors

As for the oil majors, such as ExxonMobil, Shell, Chevron ConocoPhillips and Hess Corp, exploration and new project spending is bring cut to stay financially afloat, while preserving the production infrastructure that will allow them to compete and grow when the market recovers. They demonstrate differing approaches to secure future growth, such as deferring deepwater operations or choosing to narrow focus to their areas of expertise. One oil major interviewee spoke of ‘cost savings through synergies.’

Downstream refineries

Malaysia’s state oil company, Petronas, is developing a US$27bn refinery and petrochemical integrated development project, called RAPID, and other associated facilities in Johor, just across from the causeway to Singapore. The project is planned to start-up in 2016 and will compete against Singapore’s refinery exports. One interviewee observed that ‘RAPID was costed with high feedstock prices’, so there are potentially windfall profits, and high revenues to government from the low-cost oil and gas inputs. By contrast, the Viva Energy oil refinery in Geelong (formerly owned by Shell), which has a domestic supply focus, does not have the scale seen in the Malaysian project.

The research project’s interviews and other data collection is continuing. The research will make a contribution to an understanding of the interplay between world commodity strategies and government taxation revenues.

In April 2016 Diane Kraal plans to present the material covered by this article at the Kay Bailey Hutchison Center for Energy, University of Texas, Austin; and she will be researching with the extractive industry group at the International Monetary Fund (IMF) in Washington DC.

Recent Comments