Conventional wisdom has it that countries reliant on natural resource exports are particularly vulnerable to external shocks. Their economies usually depend on a small range of export products, the prices of which oscillate on world markets. This makes them highly volatile as revenue sources.

In addition, reliance on extractive industries often crowds out investment in other sectors (the infamous ‘Dutch disease’), resulting in less diversified economies and smaller tax bases. Access to rents from natural resources eases the fiscal pressure of governments, making them less inclined to exploit other sources of revenue.

But is this wisdom supported by empirical findings?

Volatility is not the same as vulnerability. Countries that can handle external shocks through sound macroeconomic and fiscal management might well be less affected than others, even if the shocks are larger. Revenue volatility of resource-dependent countries could depend not only on exogenous factors, but also on domestic ones, such as widespread rent-seeking, corruption, limited state capacity, and economic mismanagement. This is sometimes referred to as the ‘political resource curse’.

Measuring volatility and vulnerability

Using a new dataset involving over 160 countries in the period from 1980 to 2010, our study finds that – not surprisingly – resource-dependent countries are exposed to larger and more volatile terms of trade shocks than non-resource-dependent ones.

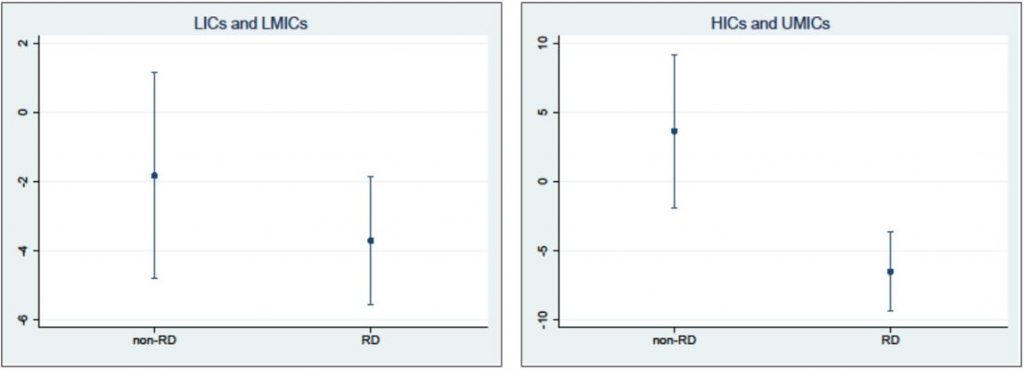

However, the way that resource-dependent countries deal with these shocks is far from uniform. First, the reliance on natural resource exports makes a much greater difference for public revenue in richer countries than in poorer ones (Figure 1).

Figure 1: Sensitivity to terms-of-trade shocks, resource-dependent vs non-resource-dependent countries

Note: RD = resource dependent, LIC = low-income country, LMIC = lower middle-income country, HIC = high-income country, UMIC = upper middle-income country. Dependent variable is change in government revenue as a result of one unit change in the shock variable. Source: authors’ calculations based on the ICTD Government Revenue Dataset, the World Development Indicators (WDI) and IMF data (2012).

Note: RD = resource dependent, LIC = low-income country, LMIC = lower middle-income country, HIC = high-income country, UMIC = upper middle-income country. Dependent variable is change in government revenue as a result of one unit change in the shock variable. Source: authors’ calculations based on the ICTD Government Revenue Dataset, the World Development Indicators (WDI) and IMF data (2012).

These findings suggest that revenues of poorer countries are more vulnerable to terms-of-trade shocks, regardless of their dependence on natural resources. In fact, differences between resource-dependent and non-resource-dependent countries in this group are small and only weakly significant.

In contrast, dependence on natural resources is a real game-changer in the group of richer countries and clearly associated with greater vulnerability. The diversified revenue structure of richer non-resource-dependent countries, in particular their lower reliance on non-tax revenue, makes them more resilient to external shocks, both compared to poorer countries in total and to the richer resource-dependent countries.

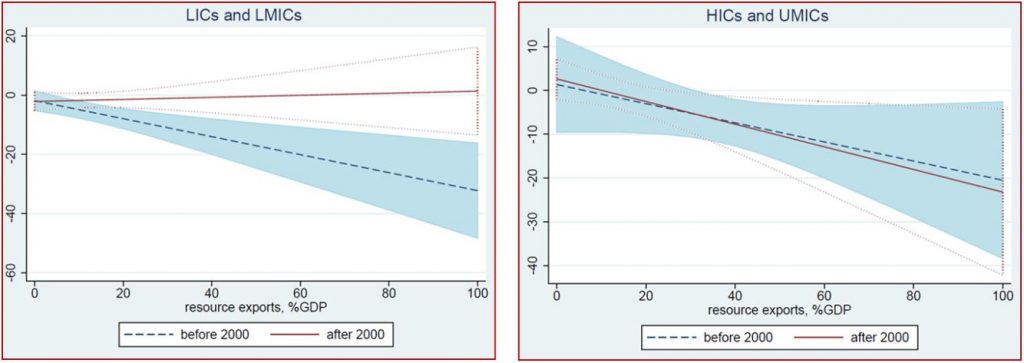

The sensitivity of poorer countries’ revenue to terms-of-trade shocks also changes over time (Figure 2). Poorer resource-dependent countries – in particular, those with a ratio of resource exports to Gross Domestic Product (GDP) above 25 per cent – performed clearly better in the 2000s, compared to the two decades before. No such change can be observed for the group of richer countries.

Figure 2: Sensitivity to terms-of-trade shocks, 1980–2000 vs 2001–10

Note: dependent variable is change in government revenue as a result of one unit change in the shock variable (log_tot_wdi_impexp). Source: authors’ calculations based on the ICTD Government Revenue Dataset, the World Development Indicators (WDI) and IMF data (2012).

Note: dependent variable is change in government revenue as a result of one unit change in the shock variable (log_tot_wdi_impexp). Source: authors’ calculations based on the ICTD Government Revenue Dataset, the World Development Indicators (WDI) and IMF data (2012).

We see this finding as the outcome of improving resource management in those poorer resource-dependent countries. The transparency of fiscal regimes improved in some countries. Kazakhstan and Azerbaijan, for example, switched from classified discretionary contracts for each new oil well to an open legislature. Several countries, including Nigeria and Mongolia, adopted fiscal rules for dealing with the volatility of commodity prices. Among the richer countries, the benefits of learning and institutional reform may have been too small to show up in the results.

Is the nature of the political regime associated with the vulnerability of government revenue? Our findings show that non-democratic regimes in general are indeed more vulnerable to terms-of-trade shocks. This applies especially to the poorer countries. However, we find almost no difference between resource-dependent and non-resource-dependent countries in this respect. This suggests that high (or low) quality of governance in general does not necessarily translate into high (or low) quality of governance of the resource sector.

Political resource curse matters

Overall, our findings suggest that factors associated with the political resource curse do influence the vulnerability of government revenues to terms-of-trade shocks.

However, at the aggregate level of analysis discussed here, significantly different patterns emerge with regard to resource dependence, government income groups, regime type and time periods.

The growing availability and reliability of fiscal, macroeconomic and governance data in poorer countries opens options for more detailed analysis in the future.

Further reading:

This article is based on von Haldenwang, C & Ivanyna, M 2018, ‘Does the political resource curse affect public finance? The vulnerability of tax revenue in resource-dependent countries’, Journal of International Development, vol. 30, no. 2, pp. 323-344.

Recent Comments