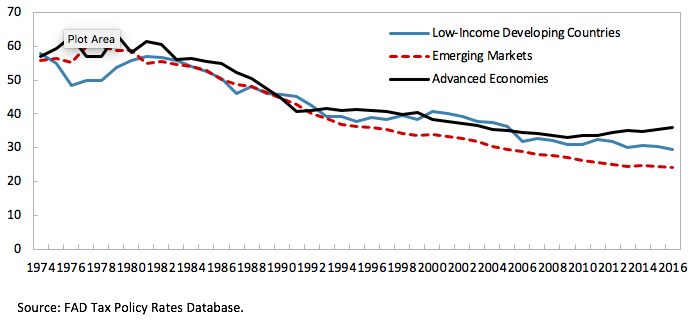

Top personal income tax rates have been falling over the last few decades in many countries, spanning different regions and income levels (Figure 1).

Figure 1. Top Personal Income Tax Rates (in percent)

What could be the reason for this decline in top rates – or more generally for the declining progressivity of tax systems? This question is very interesting, but also very hard to answer. In a recent working paper, we tackle the related and slightly more restricted question of whether people have become more sensitive to tax rates.

What does optimal tax theory tell us?

Optimal tax theory links the level of the top tax rates to three main factors: (i) the sensitivity of income to tax rates, (ii) the share of income earned by those on the highest incomes, and (iii) the welfare weight placed on those with the highest incomes. In case of the sensitivity to tax rates, there is an inverse relationship: the more income reacts to changes in rates, the lower the optimal tax rate. Potential reasons for such an increase in sensitivity include easier access to international tax planning, or the lower corporate income tax rates that may encourage shifting personal income into corporate income for tax purposes. An increase in sensitivity would be a good candidate explanation for falling top tax rates, so we set out to find some empirical evidence.

To restate the same idea in more technical terms, we calculate elasticities of taxable income (ETIs) to see whether they have risen. The elasticity of taxable income is a measure of how sensitive incomes are to tax rates. Specifically, it is defined as the percentage change in taxable income relative to the percentage change in the retention rate – that is, the share of income that a person keeps after tax. This is also known as a net-of-tax rate, and it is simply 1 minus the tax rate.

A high elasticity means that an average person would raise their pre-tax income a lot if the tax rate were to fall (and hence the retention rate to rise). How exactly people raise their incomes will depend on their circumstances: an employee may work more hours or search harder for better-paying jobs. An entrepreneur or self-employed person has more margins, and in addition to working more or harder may also be more compliant, boosting reported incomes.

How to estimate elasticities of taxable income

To estimate an elasticity of taxable income, we need data on taxable income and tax rates. Moreover, we need tax reforms to occur, as otherwise the retention rate would not change. Most countries do not change their personal income tax rates frequently, so if we want to assess changes in elasticities of taxable incomes over time, the best strategy is to collect data from as many countries as possible, as in most years there will be a tax reform somewhere.

Given the focus on top tax rates, we need data on high incomes, such as those of the richest 1 percent (the top percentile) or the richest 5 percent of the population (the top ventile). Hence, we cannot simply use average income or GDP per capita. Fortunately, a data set on high incomes has recently become available: the World Inequality Database. One of the strong features of this database is that it combines survey results with other data sources to address the typical under-representation of the richest individuals in surveys. Data on tax rates and thresholds are available from the OECD tax database.

Estimating elasticities of taxable income is challenging: in any given country, at any given time, there will be many reasons for changes in taxable income. Apart from changes driven by tax reform – which we are interested in – there can be changes from technological advances, trade shocks, macroeconomic developments to name a few. Any single estimated elasticity of taxable income is therefore unlikely to be precise, but by using a large data set we can focus on general trends.

There are various methods that can be used to improve estimates of elasticities of taxable income, but they usually reduce the number of estimates. For example, we can calculate a so-called difference-in-differences measure of the elasticity. The idea behind this is that we look at the additional growth in income of the top percentile relative to the rest of the top ventile, and compare this to the additional change in the retention rates of both groups. By doing so, anything else that is going on in the economy and that is favoring all high-income individuals is disregarded in calculating the elasticity.

However, this only works if the change in the retention rate for the top percentile of the population is different from that of the top ventile, which is only true if the top bracket starts at a very high income, as otherwise everyone in both groups simply faces the top tax rate. Because of this trade-off between the theoretical quality of measures and the number of elasticities of taxable income that can be calculated, we produce estimates using various methods rather than choosing one approach.

And the answer is: no.

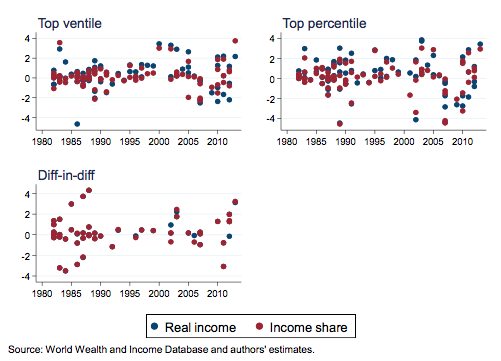

Or more precisely: there is no statistical evidence of an increase in elasticities of taxable income. No matter how exactly we define the elasticity of taxable income, the resulting elasticities do not exhibit trends.

Figure 2 gives a typical picture that is obtained when plotting elasticities of taxable income over time. In addition to graphical analysis, we also regress them on time trends, with various variants and outlier exclusions, and still we do not find evidence of a trend.

Figure 2. Elasticities of taxable income (ETIs)

So, what does this mean?

The absence of a trend in elasticities of taxable income, suggests that cuts in top tax rates were not driven by rising sensitivities of income to tax. Does it mean that current tax rates are not optimal? That is a harder question to answer. The elasticity of taxable income is an important, but – even in simple optimal tax frameworks – not the only determinant of optimal top tax rates. Looking at the other main determinants of optimal top tax rates suggests that they are also unlikely candidate explanations for a drop in tax rates: (i) the share of income earned by better-off people has risen, which would suggest taxing them more, and (ii) public opinion surveys reveal, if anything, rising support for redistribution.

So most likely, the decline in top tax rates has a completely different explanation. One possibility is that it was driven by political economy factors, such as better-off individuals having greater political influence. But irrespective of the precise mechanism explaining it, low and stable elasticities of taxable income suggest that some reversal in top tax rate cuts could be undertaken, without causing a great reduction in labor supply or compliance.

This blog post is based on IMF Working Paper No. 18/132 “Are Elasticities of Taxable Income Rising?” by A. Klemm, L. Liu, V. Mylonas, and P. Wingender and on a recent IMF Fiscal Monitor chapter on Tackling Inequality, which discusses also related issues, including inequality and growth and redistribution on the spending side. The views expressed in this post are those of the authors and do not necessarily represent the views of the IMF, its Executive Board, or IMF management.

A recent paper I presented to foreshadow the 20th anniversary of GST’s introduction to the Australian Parliament contains a number of graphs to show that, compared to OECD countries, Australia has an unhealthy reliance on personal income tax and an low reliance on GST/VAT taxes – both as a proportion of total tax and GDP.

Tables 1 and 2 of the paper illustrate this.

Table 27 shows:

– the top marginal and average PIT rates,

– The average and marginal PIT rates at average earnings; and

– the average earning as a proportion of the income at which the top rate applies for the FYs: 1974/75, 1984/85, 1994/95 & 2000/01.

The paper is entitled “20 years after ANTS – is there a hole in the bucket?”

http://taxsifu.com.au/wp-content/uploads/2018/09/Evans-M-Is-there-a-hole-in-the-bucket-Sept-2018.pdf

As tax time approaches, many are debating whether high-income taxpayers should pay more or whether their tax rates are already too high. This debate is particularly relevant today because of the economic struggles many Americans are experiencing, and because of the longer-term trend of rising inequality. A host of economic forces, like changes in technology, increases in international competition, and other changes in the labor market, such as the decline of unions and a falling real minimum wage, have reduced job opportunities and wages for some American workers, but expanded opportunities and incomes for others. In fact, the earnings and market incomes of many middle-class and lower-income households have stagnated and even declined over time, while incomes at the top of the income distribution have risen dramatically. The United States has traditionally boasted a progressive tax code—one in which the tax rate increases as income increases. A key question for policymakers, then, is how the tax system should respond to the current challenges—how progressive should the tax code be?