‘The Future of Saving: The Role of Pension System Design in an Aging World’, IMF Staff Discussion Note 19/01.

The Staff Discussion Note explores how demographic changes have affected and will affect public and private sector savings, highlighting the interaction between pension systems, labour markets, and demographic variables. It uses data from 80 countries to map public (government) and private savings in countries over the next 30 years, given their aging populations and the design of pension systems.

Highlights

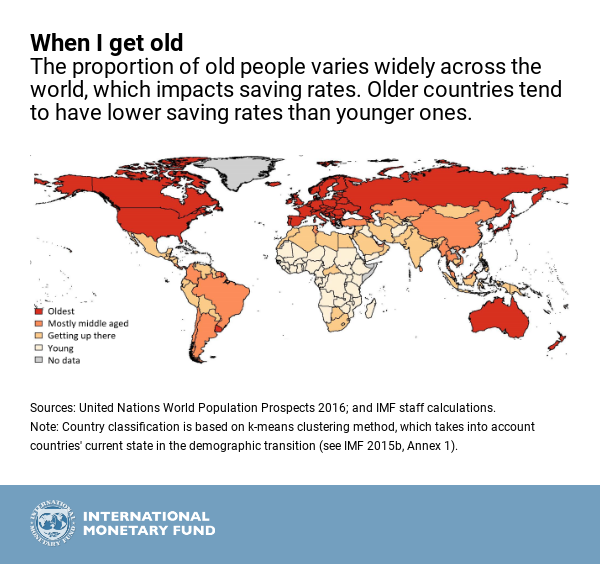

- Declining fertility rates, combined with increased life expectancy, will result in older populations in the coming decades. As a result, by 2050, on average, the old-age dependency ratio―the ratio of the elderly population (65 years and older) to the working age population (15–64 years)—will double.

- The authors find that trends in private saving drive the development of national saving. In emerging markets and low-income developing countries collectively, relatively young populations lead to increased private saving. In contrast, the authors expect private saving rates in aging advanced economies to contract sharply.

- Assuming unchanged policies, population aging will drive up public spending on pensions by just over 2 percentage points of GDP by 2050.

- The response of households’ private saving differs markedly across countries, with pension system characteristics a major factor determining how much households save.

- The authors stress that policymakers need to understand what drives these changes in saving rates, as savings provide a form of insurance against downturns and, by financing investment, stimulate long-term economic growth. The study suggests governments can help their citizens by stimulating the development of financial sector instruments to encourage voluntary saving and adopting policies to encourage people to lengthen their productive lives. In emerging markets and low-income countries, they could also further stimulate work in the formal sector.

Findings on Australia

- Australia, like most advanced economies and some emerging market countries, is in the late stage of demographic transition, with aging well underway and the working age population declining or about to decline. A lower share of workers in the population means that output per capita will fall and national saving rates could potentially decline, owing to increased transfer payments to and lower private saving rates among the growing elderly cohort.

- While United Nations projections suggest that the working age population will fall by about 20 percent in Europe between 2015 and 2050 and by almost a quarter in Korea, in the United States, Australia, and New Zealand, the working age population will still be growing over this period.

- The median age in Australia is notably lower than that in many other countries in the late demographic stage owing to relatively high immigration.

- Due to its defined contributions scheme relative to national income, aggregate saving in Australia is expected to increase at a much faster pace than in Russia, for instance, where the defined contributions scheme is more generous. Projections for China and Korea also suggest that low pension generosity drives up precautionary private saving.

(Source: IMF SDN 19/01 | IMF Blog)

Recent Comments