Bilateral tax agreements ensure that incomes earned across borders are not taxed twice. However, the provisions of these agreements can be used to avoid taxes. To tackle such base erosion and profit shifting (BEPS), the current network of agreements must be suitably modified.

Given the number of agreements, modifying these is an arduous task, demanding time and resources. To overcome such hurdle, the Organisation for Economic Co-operation and Development (OECD) and G20 mandated the development of a multilateral legal instrument (MLI) to implement tax treaty related measures to prevent BEPS. This instrument allows a country to simultaneously modify several agreements. Although the instrument provides a practical alternative to bilateral renegotiation, countries may be apprehensive to sign it since it can affect the sovereignty to tax and alter bilateral specificities in agreements.

To allay such fears, different kinds of flexibilities were incorporated in its design. Participation in the development of the instrument did not entail a commitment to sign the MLI. Further, countries that signed the MLI are given the choice to list agreements they seek to modify. Lastly, signatories are given the choice to opt out certain articles and to pick among alternative measures provided in the mandatory articles. Such flexibility is necessary for consensus; however, it can potentially lessen the change introduced to existing bilateral agreements. It is in this context that I evaluate the MLI.

On 7 June 2017, 68 jurisdictions signed the MLI, later joined by 10 more jurisdictions as of March 2018, and each of these submitted their respective MLI positions to the OECD. Using the country positions of 78 countries and jurisdictions, I constructed a dataset. In the ensuing discussion, some interesting facts, based on the analysis of this dataset, are presented.

Are significant treaty relationships covered?

A bilateral tax agreement will be a covered tax agreement under Article 2 of the MLI when it is listed by all contracting jurisdictions. By 22 March 2018, 2,446[1] agreements had been listed by 78 countries and jurisdictions. But only about half of these were covered tax agreements. Thus, a large number of agreements remain outside the scope of the MLI, because either one of the contracting jurisdictions has not yet signed the MLI or has not yet listed the agreement.

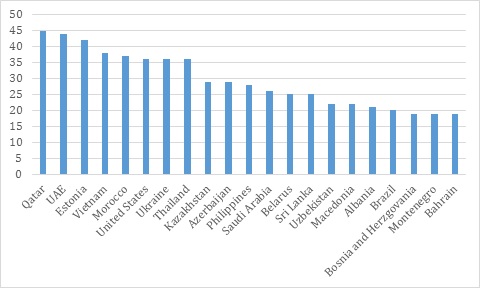

It is possible to identify the contracting jurisdictions to which these agreements can be attributed. Aggregating the number of listed treaties a signatory of the MLI has with the jurisdictions that has not yet signed the MLI, Qatar ranks the highest followed by the United Arab Emirates (UAE), Estonia[2] and Vietnam (Figure 1). Some important countries such as Brazil and the United States were members of the MLI negotiating group but have not yet signed the MLI, so none of their treaties are covered by the MLI.

Figure 1: Number of treaties signatories of the MLI have with countries yet to sign the MLI

Source: Estimated from country positions, OECD

Source: Estimated from country positions, OECD

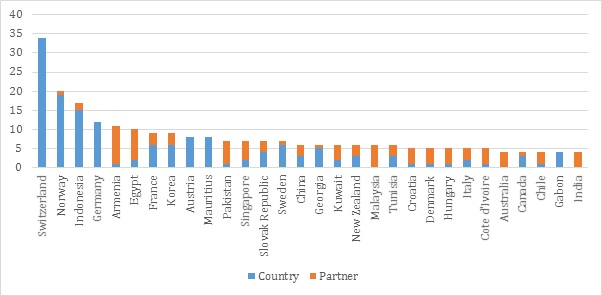

Further, in March 2018, an estimated 170 agreements were not covered tax agreements because signatories chose not to list them. For example, Switzerland has not listed many of the agreements that have been listed by partner jurisdictions; Germany is a similar case. On the other hand, for countries such as Australia, India and Turkey, it is the partner countries that have not listed all the unmatched agreements (Figure 2).

Figure 2: Number of tax agreements that did not match due to the country or partner

Source: Estimated from country positions, OECD

Source: Estimated from country positions, OECD

Why does it matter if bilateral treaties are not covered?

Bilateral agreements eliminate double taxation that may occur in case of cross-border trade and investment. The fact that many of the agreements will not be covered tax treaties is problematic if these are agreements between significant investment or trade partners, and BEPS measures are introduced by one or other country that could lead to double taxation.

To evaluate this, I calculate the bilateral stock of outward and inward foreign direct investment (FDI; IMF 2015) for signatories with unmatched agreement. It is observed that some agreements that are not yet covered are between jurisdictions with bilateral FDI stocks in excess of 10 percent of the total. To name a few, India-Mauritius, Singapore-Mauritius, India-Germany, Netherlands–Croatia, Poland–Netherlands, Egypt-Mauritius and Fiji-New Zealand. Very strong bilateral investment ties are observed for Egypt and Mauritius and Fiji and New Zealand, where the latter account for more than 60 percent of the former’s outward FDI stock.

Optional Articles in the MLI

Other than the coverage, the extent of modification to bilateral agreements will depend on the adoption of the optional articles in the MLI. Each of the optional articles in the MLI contains a reservation clause, by which a jurisdiction can opt out of the article.

More than 60 percent of the signatories have opted out of Articles 3, 4, 10, 11, 12 and 14.

A controversial article relates to reaching agreement between the countries on a tax burden through international arbitration. Mandatory Binding Arbitration was the only article where a country choosing to apply has to opt in. So far, only 26 countries have indicated their choice to apply arbitration, so it will only apply to 178 agreements out of 1,225 matched agreements.

Developing vs developed countries

Negotiating bilateral agreements is particularly challenging for developing countries. Will developing countries indeed gain from signing the MLI?

Two advantages can accrue to developing countries by joining the MLI. One, modification of a large number of agreements at once; and two, the wider application of relevant articles to their agreements.

However, a higher proportion of developed countries tend to exclude agreements from the MLI, and they do so more with developing countries (Table 1).

Table 1: Number of unmatched agreements by type of country

| Country that notified the agreement | |||

| Developing countries | Developed countries | ||

| Country that did not notify | Developing countries | 35 | 23 |

| Developed countries | 72 | 40 | |

Source: Estimated from country positions

Developing countries should be particularly interested in adopting measures that address the artificial avoidance of permanent establishment (PE) status which enables business taxation of a foreign investment in a country.

But Article 12 (artificial avoidance of permanent establishment status through commissionaire arrangements) and Article 14 (splitting up of contracts) of the MLI have been adopted by approximately 50 percent of developing countries, compared to less than 30 percent of developed countries.

Among the developing countries that have opted out of these articles, many are those identified as low tax or preferential tax regimes, including Guernsey, Isle of Man, Jersey, Korea, Seychelles, Mauritius, and San Marino. China has also surprisingly opted out of all the permanent establishment-related articles.

It is well known that developing countries such as India and China are opposed to including Mandatory Binding Arbitration in their agreements. Only 5 developing countries—Andorra, Curacao, Fiji, Mauritius, Singapore—have opted for arbitration, all of which are known preferential tax regimes (Fiji was on the European Union grey list in 2017). Only 33 agreements with developing countries will incorporate arbitration.

Anti-abuse rules for treaties

A minimum standard for the MLI is prevention of treaty abuse, in Article 7. A country can choose to apply variations of an anti-abuse rule, including the Principal Purpose Test or a more complex Limitation on Benefit rule.

A detailed matching of anti-abuse measures selected by each treaty partner is carried out. It is observed that Principal Purpose Test will apply to 84 percent of the agreements covered by the MLI and to another 10.7 percent the Principal Purpose Test will apply along with para 4, which allows the taxpayer to request the competent authority of the contracting jurisdiction to consider facts and consult the competent authority of the other contracting jurisdiction. Only 9 countries have opted for a detailed Limitation on Benefit article that will affect only 10 treaties.

Is the MLI useful for developing countries?

The exclusion of some significant agreements, as well as opting out of specific articles of the MLI, compels one to re-consider the utility of the MLI. It seems likely that many measures to address BEPS may still be adopted through bilateral negotiation and not the MLI. However, the MLI is indeed a novel initiative and it is leading for the time being to the swift adoption of the anti-abuse measures in a large number of tax agreements.

[1] Note that in some cases old and new treaties have been notified in such cases the latest treaty is counted.

[2] As of March 2018, Estonia had expressed its interest in signing the MLI.

A lucid and pithy insight into the host of issues confronting wide scale adoption of the MLI, particularly amongst developing countries. Well done.