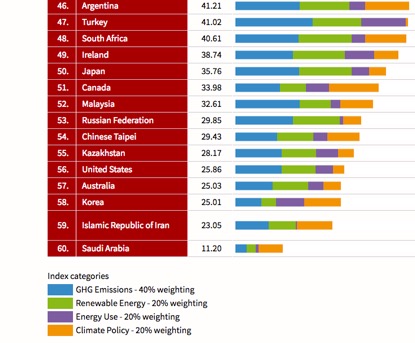

In November 2017, the latest Climate Change Performance Index was released. The Index’s annual review of climate change policies in 60 countries confirmed that, in Australia, not much has changed. Like in 2016, we rank as one of the lowest performing countries, at 57th out of 60 (Figure 1).

This year’s results “demand that [Australia’s] government sufficiently implement credible policies for meeting their targets.” It echoes last year’s index, which critiqued our policies for being “unambitious and uninspired.” It is clear that Australian environmental regulation requires re-evaluation. And our 2011 national Climate Change Review shows taxes are one of the predominant regulatory methods to reduce emissions.

We therefore should be exploring what our tax policies could be doing to improve our effect on the environment.

Figure 1. Countries with “very low” results in the latest Climate Change Performance Index

Source: Climate Change Performance Index

Why behavioural economics?

There are many ways in which environment-related tax policies can be evaluated. One way that is often used is through traditional economics. Another way is through a less-traditional economics framework: behavioural economics.

Behavioural economics draws on insights from psychology, as well as neoclassical economics, to understand individual decision-making processes. It gives us a way to evaluate Australian environment and tax related policies in a new light, without rejecting past economic analyses.

Here, I use behavioural economics to analyse one particular environment-related tax: the Harbour Bridge Congestion Charge. In my journal article, which this post summarises, I also evaluate the Emissions Trading Scheme, the new Emissions Reduction Fund, environmental tax cases and pro-compliance messaging.

To evaluate the charge, my post first refers to what insights behavioural economics has for congestion charges in general. I draw many of these insights from Leicester, Levell & Rasul (2012), who analyse the behavioural economics framework directly in relation to taxation policy. Then I explore whether the charge incorporates those insights, and consequently what could be done to environmentally ameliorate both charges like this, and taxation policy more generally.

Behavioural economics’ insights for congestion charges

A major way to explore taxes such as the Harbour Bridge Charge through behavioural economics is by analysing salience. The concept of salience highlights that corrective taxes like congestion charges, which aim to influence consumer behaviour, will not in fact be corrective if they are not salient.

Behavioural economics’ focus on tax salience stems from the concept’s interest in framing. According to behavioural economics, framing—the way that choices are presented to consumers—can greatly influence what choice those consumers end up making. The salience, or visibility, of a tax is a major element of framing.

Leicester, Levell & Rasul argue that it is generally only useful to make a tax less salient (so consumers do not notice it) if the tax’s goal is to increase revenue. However for environmental taxes, the goal is often not to increase revenue, but to correct behaviour.

Some other problems with less salient taxes are that they risk imposing direct costs on consumers, and introducing complexities related to tax avoidance and negative distribution. For behaviour-influencing taxes such as those linked to the environment, it is often particularly important to neither impose direct costs on consumers nor create issues related to tax avoidance and negative distribution.

Therefore, environmental taxes will likely be more effective if they are more salient; unlike revenue-increasing taxes that may be more effective if they are less salient.

It is important to note that salience can relate not only to the quantity of a tax that is being imposed, but also to the environmental agenda that a tax has. This means that the name or label attached to a tax can influence consumer reactions to it. Analysing the salience of a tax’s environmental goal also draws attention to how the tax is explained.

For example, the fact that pictorial health warnings are included on cigarette packets along with an imposed tax makes the health aspect of a consumer’s choice more salient.

The salience of some environmental taxes could be increased in a similar way if there were regulations that, for example, required car showrooms to display the fuel-efficiency-based excise duty of the cars; or that required electric durable prices to be displayed in stores.

Applying the insights to the Harbour Bridge Charge

Analysis of Australia’s most prominent congestion tax suggests it is not salient in relation to either the tax’s cost or the tax’s purpose. Drivers are now required to pay a congestion charge between $2.50 and $4 when they use Sydney’s Harbour Bridge. Yet, the charge’s lack of salience is already seen in how it necessitates a tag, meaning that all tax payments are automatic. Since automatic payments reduce how noticeable a tax is to taxpayers, the charge has a low salience that, as described above, decreases its effectiveness at changing taxpayer behaviour.

Of course, another strong factor that explains the charge’s ineffectiveness at changing taxpayer behaviour is its low elasticity, because the Harbour Bridge is often a more convenient commuting option for consumers, even when factoring in the cost. However the charge’s low salience is a factor many analyses of toll road inefficiencies overlook.

Like the lack of salience in the charge’s cost, the charge’s purpose is also unclear. When the charge was imposed in January 2009, its stated goal was to reduce congestion, in a pro-environmental way. As the NSW Acting Roads Minister, David Campbell said, “some people will change their driving patterns and that’s what we’re aiming for them to do.” However, 2011 reports on the charge show not only that the tax had no effect on traffic congestion, but also that the Government was nevertheless keeping the tax because it generated over $5 million in government revenue per year.

The charge has therefore been problematic because of a shift in what the Government saw as its goal. The ministerial policy went from aiming to correct taxpayer behaviour to aiming to raise revenue. This shift not only created ambiguity in the importance of salience to the tax since, as mentioned, salience is less important when a tax is aiming to raise revenue as opposed to influencing behaviour. The shift also highlights the concerning ease with which the Government was swayed from prioritising goals related to ameliorating environmental conditions, to goals primarily focused on maximising income.

More recent work on congestion charges in Australia suggests a positive change in approach to tax salience and governmental priorities. A 2016 private sector-led inquiry into how to decrease congestion in Australia incorporates various insights that behavioural economics has for environmental taxes.

First, the study highlights how clarifying a policy’s objectives, such as deciding whether it aims to raise revenue or correct polluting behaviour, can increase support for a policy.

Secondly, the inquiry emphasises that “in addition to clear objectives, transparency is also essential”. Transparency is key to salience since, as seen above, making a tax’s goal and cost transparent to consumers makes behaviour-correcting taxes more effective. The fact that we do not know what the charge’s goal is, or when we have automatically paid it, could be changed to make it more transparent to us taxpayers.

Unfortunately, the study has not had much public impact. And although there has been other research in favour of implementing congestion taxes, there does not seem to be Australian research that highlights the benefits—both environmental and otherwise—of a transparent, clear congestion charge. This confirms how much more could be done to incorporate the insights that behavioural economics has for such policy.

Conclusion

The Climate Change Performance Index ends by thanking the contributing experts, who are “fighting for the implementation of the climate policy that we all so desperately need.” It is telling that the Index states these experts are mainly non-government representatives. Climate change remains one of the social issues that we as a nation have been less attentive towards.

Through its evaluation of the Harbour Bridge Charge, this post has given a taste for how much national environmental tax policy can learn from behavioural economics. If we can encourage a political will to undertake such learnings, more inspiring, ambitious and credible policy in Australian environmental taxation can be achieved.

Recent Comments