Prime Minister Malcolm Turnbull says the government is considering “all options” when it comes to tax reform. But shouldn’t we find out what works (and what doesn’t) before we start talking about reforming the tax system?

Fortunately, we have experts who can sort out the nitty gritty once the community and the government have decided what they want. Not everyone has to understand all the details as long as the experts know how the tax system works.

But even experts use theory and models to form their views. How well do the experts know the Australian tax system?

Take payroll tax, for example. If you are not a tax expert, then you probably think that payroll tax is a tax that has to be paid by firms. But economic theorists will tell you that payroll taxes are actually borne by workers.

Why?

The typical argument about who bears the burden or incidence of payroll tax goes like this

‘Economists look through the legal incidence on employers to the underlying economic incidence, and see payroll tax being shifted to consumers (through higher selling prices) or employees (through lower wages).’

Increasing prices may be difficult for firms in a competitive market. However, if we assume that payroll tax is not being shifted to consumers, then we should expect based on the theory that workers bear the burden of payroll tax through lower wages.

Interestingly, firms in Australia have lobbied against payroll tax. If you are not an expert, then you might find that surprising (because you have just learnt that firms do not actually pay payroll tax but pass it on to workers in the form of lower wages). But the Henry Tax Review offers an explanation for this behaviour. It says that firms can ‘feel the burden of payroll tax’ because ‘an increase in payroll tax rates may not feed through to lower wages until wages can be renegotiated’.

The Review also quotes the following explanation:

‘Even though most of the economic incidence of payroll tax may not fall on employers, the illusion that it does may be so strong that it actually influences business behaviour’.

Are firms subject to a fiscal illusion?

A first look at the real world

An interesting feature of payroll taxes in Australia is that they vary across regions and change over time. Each State and Territory has a different tax rate, and the rates have changed frequently over the years. There are also a number of exemptions that I will not discuss here.

Based on the data I have collected about payroll tax rates, at least 28 changes in payroll tax rates have taken place between 2000 and 2014. Because payroll tax rates do not change everywhere at the same time (occasional changes only affect individual States and Territories), I also observe 99 situations in which the tax rates have stayed the same.

I will call the 99 data points my ‘control group’, which I can compare against the 28 tax reforms, my ‘treatment group’. This setup allows me to perform a ‘natural experiment’, that is, I can study the effect of changes in payroll tax rates on hourly wages and consumer prices in each of the States and Territories. [1]

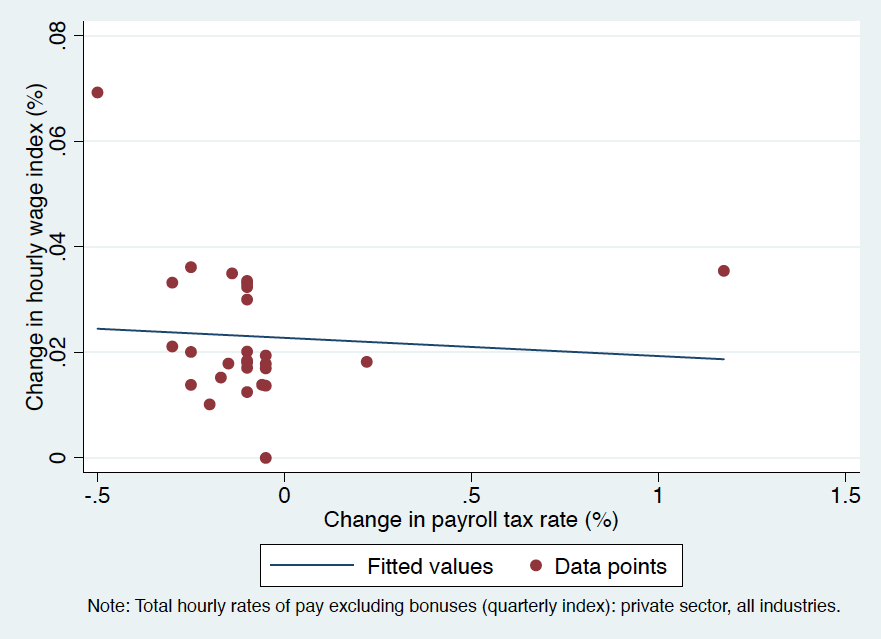

How does the relationship between changes in payroll tax rates and changes in hourly wages look like? If I plot a picture of the 28 tax reforms, I can see that an increase in payroll tax rates is associated with a lower hourly wage index (see figure below). However, this relationship is quite weak: the fitted line is almost flat.

Figure 1: Relationship between payroll tax changes and changes in hourly wages

Source: Author’s Calculations

The relationship depicted in the figure is not causal because I have ignored the control group. When I compare treatment and control groups,[2] I find that the estimated causal effect of payroll tax rate changes on hourly wages is not statistically significant (i.e. it is zero).

I can do a similar analysis looking at changes in the consumer price index. My findings indicate that changes in payroll tax rates do not have a significant effect on consumer prices. This suggests that the payroll tax burden in Australia is neither being shifted to consumers (through higher prices) nor to workers (through lower wages).

What about the timing of events? The Henry Tax Review tells us that wages may be inflexible in the short run but will adjust over time. I have only studied the effect that a tax rate change (between two quarters) has on the change in wages in the following quarter.

When I extend my analysis to the effect on wages six month later, I still find no effect. Nine months later: no effect. Twelve months later: nothing. Fifteen months later: still nothing. … I gave up after 36 months because it seemed unlikely to me that an effect would appear more than three years after a tax rate change.

But if tax rate changes have no effect on prices and wages, then one could argue that there must be an effect on employment – the third channel through which firms can react to an increase in payroll tax rates. I have tested this. There are no employment effects.

Although these findings are very preliminary, they illustrate that, in the absence of empirical evidence, many experts rely, disproportionately and dangerously, on theories or models that may be wrong or irrelevant in the real world. Beyond theoretical assumptions, we still know relatively little about the effects of taxes in Australia.

Regardless of the reforms that the Australian government will undertake, better empirical research on the tax system is essential if we are to achieve lasting positive change in any tax reform process.

Footnotes:

[1] I use hourly wage and consumer price indices of the Australian Bureau of Statistics.

[2] I also take into account permanent differences between States and Territories and I net out seasonal variation.

Hi Mathias, would you be willing to share the data?